AMORTIZATION CALCULATOR

What is Toolerz Amortization Calculator?

Toolerz Amortization Calculator is a user-friendly designed calculator that can give a complete breakdown of every monthly payment, showing how much goes toward principal and how much goes toward interest

The amortization calculator gives the monthly payment amount in a fixed-rate mortgage.

Amortization Calculator Formula

The formula for calculating the monthly payment (EMI) in an amortizing loan is:

Where:

EMI is the Equated Monthly Installment,

P is the principal amount or loan amount,

r is the monthly interest rate (annual rate of interest divided by 12 and multiplied by 0.01 to convert to a decimal),

n is the total number of monthly installments (loan tenure in years multiplied by 12).

In the context of amortization, each monthly payment consists of two parts: principal and interest payment. Each month a portion of principle amount and the respective interest amount has been paid.

Interest Payment=Pxr

The portion of the EMI that goes towards the principal is calculated by subtracting the interest payment from the total EMI:

Principal Payment=EMI-InterestPayment

After each monthly payment, the outstanding loan balance is reduced by the principal payment. The process is repeated for each month until the loan amount is paid fully.

The Outstanding Balance is the remaining loan balance after "n" payments.

This formula helps you understand how much of the principal is remaining after a certain number of payments have been made.

What is Amortization?

Amortization is a financial process that involves the gradual repayment of a

loan over a given period. It breaks down the total amount borrowed into

smaller, periodic payments, mostly monthly payments.

Each payment consists of two components: principal & interest.

In each re-payment, there is a deduction of a portion of principal and interest.

In simple terms, for example, you took a loan to buy a house. Amortization ensures that you repay this loan gradually instead of total payment at once.

Each month, a portion of your payment goes towards repaying the loan amount (principal), and the rest covers the interest. Over time, the balance between principal and interest in your payments shifts.

In the early stages, more goes towards interest, but as the loan is paid down, a larger share contributes towards the principal amount.

People who are willing to take loans must understand the amortization process before approaching banks.

It helps them track their progress in repaying the loan and comprehend the long-term cost of borrowing.

Loan Amortization Calculator With Extra Payments in Excel

In this section, we have explained how to create a Loan Amortization Calculator with Extra Payments in Excel Sheet.

Creating a loan amortization calculator with extra payments in Excel involves setting up a table to track each payment, including principal, interest, and the additional payments made in between.

In the below section, we have explained with a simplified example of how you can create a loan amortization calculator with extra payments in an Excel Sheet:

For instance, you have the following input details:

- Loan amount: Rs. 100,000

- Annual rate of interest: 5%

- Loan term: 5 years (60 months)

- Monthly payment: Calculated using the PMT function in Excel.

- Extra payment: Rs. 50 every month.

Set Up Your Table:

Create 6 columns A, B, C, D, E, F

Column A: Payment Number (1, 2, 3, ...)

Column B: Payment Date (Start with the loan start date)

Column C: Loan Amount

Column D: Monthly Interest (Previous Remaining Balance * Monthly Interest Rate)

Column E: Monthly Principal (Monthly Payment - Monthly Interest + Extra Payment)

Column F: Remaining Balance (Previous Remaining Balance - Monthly Principal)

In the first row of Column C, enter the loan amount (Rs. 100,000).

In the first row of Column D, calculate the Monthly Interest using a formula =F2 * 5% / 12 (assuming an annual interest rate of 5%).

Remember to monitor and update your amortization table, especially when you make extra payments, to see how they impact the repayment timeline and total interest paid.

What is an Amortization Schedule?

An amortization schedule is a table/ spreadsheet/Excel sheet that provides a detailed breakdown of each loan payment over the entire term of a loan.

It outlines how each payment is allocated for principal amount and interest, and it shows the remaining balance to be paid after each payment.

The schedule is a helpful tool for borrowers as it offers a clear picture of how the loan is being repaid over the given term.

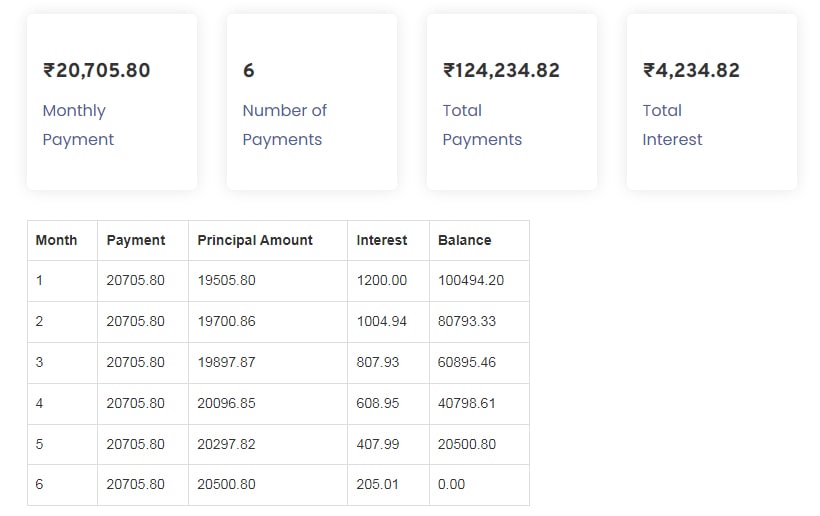

The below figure gives a clear picture of how the Amortization Schedule looks like.

Want to maximize your savings? Try our Compound Interest Calculator to see how your money can grow over time.

Spreading Costs: What It Means and Why It Matters

Spreading costs means dividing large expenses over a period of time instead of paying all at once. This approach is helpful in managing budgets, especially for businesses and individuals with limited cash flow. For example, if a company buys new equipment, it may spread the cost over several months or years instead of recording the full amount at once.

This method helps in planning finances better and avoids sudden financial pressure. It is also known as cost allocation or expense amortization in accounting. Spreading costs can apply to various areas, such as loan repayments, subscription services, or project budgets.

By spreading costs, businesses can maintain smoother cash flow, improve budgeting accuracy, and make smarter investment decisions. It’s a practical strategy that supports long-term financial health, especially when dealing with big-ticket items or ongoing expenses.

How to read an amortization schedule

Understanding an amortization schedule can help you manage your loan better. An amortization schedule is a table that shows how each loan payment is split between interest and principal over time.

The schedule usually includes columns for the payment number, payment amount, interest paid, principal paid, and remaining balance.

At the start of your loan, most of your payment goes toward interest. As time goes on, more of the payment reduces the principal.

By reviewing the schedule, you can see how your balance decreases with each payment and how long it will take to pay off the loan.

This tool is especially helpful for mortgages, car loans, or any fixed-term loan. It gives you a clear picture of your repayment journey and helps with budgeting.

Learning how to read an amortization schedule puts you in control of your finances.

For smart investment planning, you can also try our Elss Calculator and explore more financial tools.

Benefits of Amortization Calculator

An Amortization Calculator is a powerful tool for managing loans effectively. It helps borrowers understand the breakdown of their monthly payments by calculating both principal and interest components.

This clarity allows users to see how much of each payment goes toward reducing the loan balance and how much is applied to interest. By using an amortization calculator, individuals can plan their finances better, assess the impact of extra payments, and determine the overall cost of the loan.

It also aids in comparing different loan options, helping borrowers make informed decisions. Whether it’s a mortgage, car loan, or personal loan, an amortization calculator provides valuable insights for budgeting and financial planning, making it an essential resource for responsible borrowing.

Key Components of Amortization Schedule

The following are the Key components of an amortization schedule:

Payment Count: Each row in the schedule represents a specific payment, numbered sequentially like 1, 2, 3, till the term ends.

Payment Date: The date on which each payment is due.

Amount Paid: The total amount to be paid for each installment, including both principal and interest.

Principal Repayment: The portion of the payment that goes towards the principal re-payment.

Interest Payment: The amount paid towards the interest is calculated till the date of payment.

Total Payment: The sum of the principal repayment and interest payment for each installment is the total payment.

Remaining Balance: The outstanding loan balance after each payment is nothing but the remaining balance. It decreases over time as you continue to pay the monthly installments.

What Are the Effects of Amortization?

Amortization refers to the process of gradually paying off a loan over time through regular payments. One key effect of amortization is that it helps reduce your loan balance steadily, making it easier to manage long-term debt.

Each payment is divided into interest and principal—early payments mostly cover interest, while later ones reduce the principal more.

Amortization brings financial clarity, allowing borrowers to plan and budget their monthly payments effectively. It also helps reduce the overall interest burden if the loan is paid on time.

For businesses, amortization of intangible assets (like patents or trademarks) spreads the cost over several years, which helps in tax planning and financial reporting.

Overall, amortization promotes disciplined repayment, lowers financial risk over time, and improves creditworthiness.

It’s a smart financial strategy that benefits both individuals and businesses by managing debt and expenses efficiently.

What is Amortization in a Loan?

Amortization in a loan refers to the process of gradually repaying debt through scheduled or periodic payments over a specified period.

These payments consist of principal and interest amounts.

As we make regular payments, the loan amortization schedule outlines how each payment is allocated between principal and interest.

Common types of loans with amortization schedules include mortgage loans, car loans, and personal loans.

Applications of Amortization Calculator

An Amortization Calculator is a powerful financial tool that helps individuals and businesses understand their loan repayment structure.

It is widely used to calculate monthly payments, interest amounts, and the principal balance over the life of a loan. This calculator is essential for home loans, car loans, personal loans, and mortgages, allowing borrowers to visualize the repayment schedule and plan their finances effectively.

It also aids in comparing different loan options by adjusting interest rates and loan terms. Additionally, businesses can use it to assess the impact of refinancing or making extra payments.

By providing a clear breakdown of each payment, the Amortization Calculator ensures better financial planning, budget management, and debt reduction strategies.

Frequently Asked Questions

Q1 : How do you calculate Amortisation?

Ans: To calculate amortisation we need Annual interest rate, Loan tenure, Loan amount using this 3 factors we can generate monthly payment amount.

For Month payment we need to multiply interest rate with total loan amount we will to total amortisation amount, for Monthly payments divide total amortisation amount by 12 months we get to 1st month payment, Subtract the interest amount from Monthly payment remaining amount will go towards Principal

For second monthly we need to apply same process but instead of total loan amount we need to calcualte interest for remaining principal amount, same process need to apply for total tenure.

Q2: What is the formula for Amortization Cost?

Ans: The general formula for amortization loan is

Monthly payment = (Principal Amount or Loan Amount) X Monthly Rate of Interest X (1 + Monthly Rate of Interest) number of Payments / (1 + Monthly Rate of Interest) - 1"

Q3 : What is 25 year Amortization?

Ans: 25 years amortization term refers to a loan or mortgage to be paid for certain period of time at regular intervals as per the amortization plan it could be monthly as per plan, not all amortization plan will be 25 years based on tenure of loan or amount of loan it varies from 5,10,15,10 years or it can be months also.

Q4: What is Amortisation with Example?

Ans: Amortisation means dividing the total loan amount into multiple installments until total amount is paidoff.

For every payment interest is calculate based on remaining principal loan amount, every payment amount is not going to same as in every payment we are paying some of actual loan amount and interest is also going to reduce on every month so it will not be same for every month.

Q5: What is an Amortization Calculator?

Ans: An Amortization Calculator is an online tool that helps you calculate how your loan payments are spread over time. It shows a detailed breakdown of monthly payments, interest, and principal repayment.

Q6: Why should I use an Amortization Calculator?

Ans: Using an Amortization Calculator helps you:

Q7: Is the Amortization Calculator free to use?

Ans: Using an Amortization Calculator helps you:

Understand your loan repayment structure

Plan your budget by knowing monthly payment amounts

See how much interest you will pay over time

Compare different loan options before borrowing

Q7: Is the Amortization Calculator free to use?

Ans:Yes, most online amortization calculators are free. You don’t need to sign up or pay anything—just enter your loan details and get the results instantly https://www.toolerz.com/ .

Q8: Can I print the amortization schedule?

Ans:Yes, most online calculators let you print or download the full payment schedule, so you can keep a copy for reference.

Q9:Is this calculator helpful for financial planning?

Ans:Absolutely! It gives you a clear view of your loan repayment schedule, which can help with budgeting and planning for future expenses.

Q10:Can I use it for different types of loans?

Ans:Yes, you can use an Amortization Calculator for many types of loans such as home loans, car loans, personal loans, and business loans. Just make sure to enter the correct loan details.

Q11:Do I need any special skills to use it?

Ans:No, you just need to know your loan amount, interest rate, and loan term. The calculator is designed to be easy for everyone to use.