SIP CALCULATOR

Total Investment

Expected Returns

Total Value

SIP Calculator

Toolerz SIP calculator is a free online tool that helps investors estimate the potential future value of their investments in mutual funds through systematic and regular investments.

SIP is a method of investing in mutual funds where investors contribute a fixed amount of money at regular intervals (usually monthly).

Our SIP calculator requires the following inputs to calculate your returns:

- SIP Amount: The investment amount you plan to invest in SIP at regular intervals.

- Rate of Return: The expected average annual rate of return on your investment.

- Duration of the Investment: The time period for which you plan to continue the SIP.

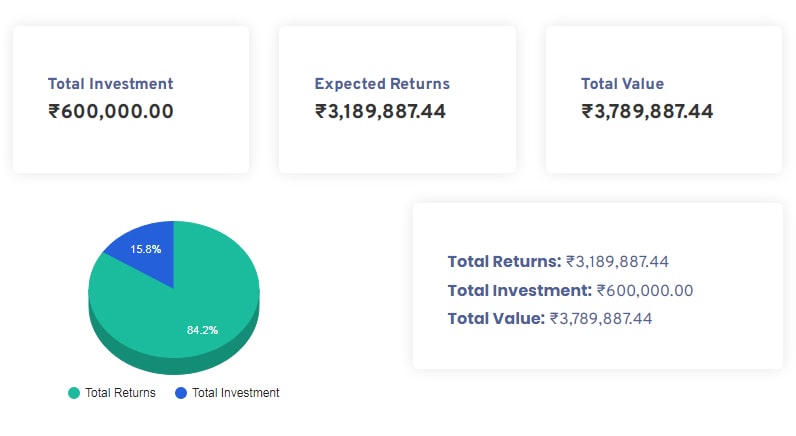

Our SIP calculator uses the above input values to calculate the returns and provide you with information such as:

Total Returns: The difference between the future value of investments and the total investment amount, indicating the total returns earned.

Total Investment Amount: The total amount you would have invested over the given period through SIP.

Toolerz SIP calculator is a valuable tool for investors to plan and understand the potential growth of their investments over time.

It provides a rough estimate and can help investors set realistic financial goals based on their risk tolerance, investment horizon, and expected rate of return.

Keep in mind that actual returns may vary, and it's important to regularly review and adjust your investment plan as needed.

For health-conscious users, our BMI Calculator helps you track your body mass index and maintain a healthy lifestyle.

Benefits of SIP Calculator

A Systematic Investment Plan (SIP) calculator can be a most valuable tool for those who want to invest in mutual funds. It calculates the estimated value of returns on the amount you have invested.

Here is how a Toolerz SIP calculator can help:

Estimate Total Value: Our SIP calculator helps you estimate the potential future value of your investment based on your monthly investments, time duration, and expected rate of return. This can give you an idea of how your investments might grow over time and make decisions accordingly.

Apart from that SIP Calculator also gives an idea if you have specific financial goals, such as buying a house, funding education, or planning for retirement. Our SIP calculator can help you determine how much you need to invest regularly to reach those goals.

Adjusting SIP Amounts: You can use this calculator to experiment with different SIP amounts to see how they impact the future value of your investments. This helps you find a contribution level that aligns with your budget and financial goals.

It is important to note that the SIP calculator provides only the estimates, the actual returns may vary based on market conditions.

If you want to invest in other than mutual funds, you can use our tool, Investment Calculator to calculate the expected returns.

How to Use Toolerz SIP Calculator

Toolerz Systematic Investment Planner Tool is a free online tool that can be accessed any number of times for absolutely free of cost.

Step-1: In order to access the tool you must visit our website www.toolerz.com and click on the link "SIP Calculator" at the bottom of the page.

Step-2: Enter the following input details

- Monthly SIP Investment

- Expected Rate of Return per Anum

- Duration of the SIP Investment

Step-3: After entering the above details, hit the calculate button to get the result.

These are the 3 simple steps to calculate SIP Investment on our website.

What is the 7-5-3-1 Rule in SIP?

The 7-5-3-1 rule in SIP (Systematic Investment Plan) is a simple guideline to understand how long-term investments can yield returns.

It refers to the average annual returns investors might expect over different time horizons. According to this rule:

-

7% return for a 1-year SIP,

-

5% return for a 3-year SIP,

-

3% return for a 5-year SIP,

-

1% return for a 7-year SIP.

These figures are just indicative and reflect the power of compounding over time.

The longer you stay invested in a SIP, the higher the potential return, mainly due to rupee cost averaging and compounding interest.

This rule helps investors set realistic expectations and promotes disciplined investing habits. However, actual returns can vary based on market performance and fund selection.

Always consider your financial goals and risk profile before investing.

Key Features of SIP Calculator

A SIP (Systematic Investment Plan) Calculator is a powerful tool designed to help investors estimate the potential returns from their monthly investments.

It allows you to input key details such as investment amount, duration, expected returns, and frequency of contributions to provide a precise projection of your investment growth.

Key features of the SIP calculator include the ability to calculate both the total investment and the final corpus after the specified time period.

It also helps to visualize the power of compounding, showing how small, consistent investments can grow significantly over time. Some calculators even allow adjustments for changes in investment amounts or returns during the investment period.

By using a SIP calculator, investors can make informed decisions, plan their financial goals, and ensure they are on track to meet their targets.

It simplifies the process of evaluating different SIP plans, making it an essential tool for both beginner and experienced investors.

How to Start SIP Investment?

Starting a SIP (Systematic Investment Plan) is a smart and simple way to begin your investment journey. First, choose a reliable mutual fund platform or financial advisor. Then, select a mutual fund scheme that matches your financial goals and risk profile.

Next, decide the monthly investment amount and the SIP duration. Most SIPs start with as little as ₹500 per month, making it affordable for everyone. Complete your KYC (Know Your Customer) process online or offline, which usually requires ID and address proof.

Once your account is set up, select an auto-debit option so the amount gets invested automatically every month. SIPs work best when done regularly over a long period, helping you benefit from compounding and market averaging.

It’s a low-risk, hassle-free way to grow wealth steadily. Stay consistent and review your progress yearly to stay on track with your financial goals.

SIP Investment Plans & Returns

Investing in a Systematic Investment Plan (SIP) can be a good strategy for generating good returns over the period.

Here are some expert tips to maximize your returns through SIP investments:

Set Clear Financial Goals:

Firstly, fix your financial goals. Find out what's the purpose of your investment. For example, buying a house, children's marriage, retirement corpus, etc., Based on your goals, you can plan your risk tolerance in your investment. You can calculate the estimated returns using our SIP Calculator on our website.

Choose the Right Mutual Funds to Invest:

Select mutual funds that align with your financial goals, and risk tolerance. Diversify your portfolio and spread your investment across various segments like equity, debt, and hybrid.

Consider Your Risk Tolerance:

Analyze your risk tolerance before investing. Equity funds have higher potential returns but come with higher risk. Debt funds, on the other hand, are more stable but offer lower returns. It is better to invest in hybrid funds to stabilize the risk.

Be Consistent:

The power of compounding works best when you start early. Consistent and disciplined investments, even if they are small, can lead to significant growth of your capital over time.

Increase SIP Amounts Regularly:

As your income grows, consider increasing your SIP amounts if possible. This will boost your investment.

Invest for the Long-Term Approach:

SIPs are designed for long-term wealth creation. Avoid withdrawing investments based on short-term market fluctuations/ volatility.

Be patient through market ups and downs to benefit from the power of compounding.

Consider seeking advice from financial professionals if you have poor financial knowledge.

Applications of SIP Calculator

A SIP (Systematic Investment Plan) calculator is a valuable financial tool that helps investors estimate the future value of their regular investments in mutual funds.

It is widely used by individuals who want to plan their long-term financial goals, such as retirement, child education, or buying a home.

The SIP calculator simplifies investment planning by providing quick and accurate projections based on monthly contribution, expected rate of return, and investment duration.

This tool is particularly helpful for new investors to understand the power of compounding and disciplined investing.

Financial advisors also use SIP calculators to create personalized investment plans for clients. Additionally, it aids in comparing different investment scenarios, helping users make informed decisions.

Whether you're saving for short-term needs or building wealth over the years, the SIP calculator makes financial planning more accessible, efficient, and goal-oriented.

Its ease of use and practical insights make it a must-have for every smart investor.

For those looking to gradually increase their investments, try our Step Up SIP Calculator.

Advantages of SIP Calculator

A SIP (Systematic Investment Plan) Calculator offers several advantages, making it an essential tool for investors. One of the key benefits is its ability to provide accurate projections of future returns, allowing users to plan their financial goals effectively.

By entering details such as investment amount, tenure, and expected returns, investors can easily visualize the potential growth of their investments over time.

Another major advantage is that it helps in assessing the impact of compounding, showing how regular, small investments can yield significant returns.

The SIP calculator also enables easy comparison of different investment scenarios, helping users choose the best plan suited to their financial objectives.

Additionally, using a SIP calculator encourages disciplined investing, as it helps investors stick to a consistent investment strategy.

Overall, the tool simplifies financial planning, increases transparency, and ensures that investors can make informed decisions about their long-term financial goals.

Frequently Asked Questions

Q1: How much will I get if I invest 5000 in SIP for 1 Year?

Ans: If you invest 5000 Rupees in SIP per month for a period of 1 year with an expected annual return of 10%, the future value of your investment could be approximately 63351.41. Please note that this is an estimate, and actual returns may vary based on market conditions.

Q2: Is SIP really good investment?

Ans: Investing in SIP is considered a popular and disciplined way of investing in mutual funds segment, and it can be a good investment strategy for various reasons. But is this a good strategy? it depends on your financial goals, risk tolerance, and level of understanding the Indian markets. Compared to direct investment in stock market, SIP is a better choice.

Q3: Why should I use a SIP Calculator?

Ans: Using a SIP Calculator helps you:

Get a clear estimate of your potential returns.

Plan your investments based on your financial goals.

Compare different scenarios by adjusting SIP amount, interest rate, and duration.

Q4: Is a SIP Calculator accurate?

Ans: A SIP Calculator provides a close estimate of returns based on assumed interest rates. However, actual returns may vary depending on market performance and fund expenses.

Q5: Can I use a SIP Calculator for different mutual funds?

Ans: Yes, you can use a SIP Calculator for any mutual fund scheme. Simply adjust the expected rate of return based on the fund's past performance or estimated growth.

Q6: Is the SIP calculator accurate?

Ans:Yes, the calculator gives you a good estimate based on your inputs. However, since market returns are not fixed, the actual value may differ. It is still a great tool for planning.

Q7: Can I calculate SIP for different durations and amounts?

Ans: Yes, the calculator is flexible. You can change the monthly amount, investment period, and interest rate to compare different scenarios and choose what works best for your goal.

Q8: Can I change my monthly SIP amount after starting?

Ans: yes, you can increase or decrease your SIP amount as needed. Many mutual fund providers allow you to adjust your SIP based on your changing financial situation. However, changes to the amount may affect the maturity value, which can be recalculated using the SIP calculator.

Q9: What is a SIP Calculator?

Ans:A SIP Calculator is an online tool that helps you estimate how much money you can earn by investing regularly through a Systematic Investment Plan (SIP) over a certain time.

Q10: Does the SIP Calculator consider step-up investments?

Ans:No, a basic SIP Calculator typically does not include step-up investments. However, some advanced calculators allow you to increase the investment amount periodically to simulate step-up SIPs.

Q11: What is the ideal duration for SIP investment?

Ans:There’s no fixed duration, but longer SIPs usually give better returns due to power of compounding. Many investors choose 5 to 10 years or even more for good growth.