MORTGAGE CALCULATOR

What is a Mortgage Calculator

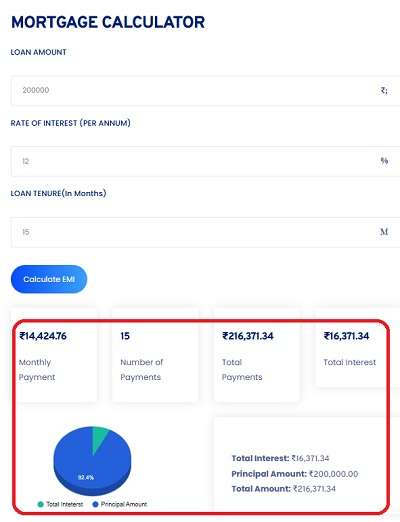

Toolerz Mortgage Calculator is a free Online Tool to Calculate monthly installments, total loan amount, and amortization schedule with options for taxes

Our mortgage loan calculator is a tool that helps you make calculations on the amount of EMI to be repaid on the obtained loan against property.

The mortgage loan calculator also displays the EMI breakup for the floating/fixed rate of interest.

What is a Loan Against Property EMI?

Financial institutions provide loans against property and you will have to make EMI repayments on your mortgaged property as per the chosen EMI.

The Equated Monthly Installment, EMI is a combination of the principal amount and the interest and you will have to make complete repayment until the set loan amount is fully repaid.

Usually, a bigger portion of the EMI containing interest amount is set for repayment, and eventually, the bigger portion is set in pace with the principal payment.

Your repayment amount is fundamentally dependent on the interest component it attracts on the loan drawn against the property.

The interest rate on the sanctioned loan amount differs from bank to bank.

What Factors Get into the EMI Calculation?

Your loan amount (Principal Amount) is completely dependent on the property that is mortgaged with banks or financial institutions. Therefore, for higher values of loan amount, you will be charged with higher EMIs.

The tenure of the mortgage loan is dependent on two important factors. They do refer to the current age and the retirement age.

Opting for a longer loan term shall reduce the EMIs thus revealing you from the burden of making you pay huge money.

You can utilize the feature of prepayment of your loan amount provided you can obtain a larger loan amount for a low interest rate.

You can opt for a loan against property from financial institutions that offer different rates as they keep changing from time to time.

Financial institutions provide two kinds of interest rates, in floating type, the interest rates do vary during the repayment period. Whereas, in the fixed type of repayment, your loan interest rate remains the same for the entire tenure.

What Formula Does Loan Against Property Calculator Use?

Financial institutions define the EMI to be paid after issuing the loan against property. These calculators use mathematical formulas that serve the purpose of the individuals who apply for a loan against property.

EMI amount = [p x r x (1 + R)^ N]/[(1+R)^N-1]

(P, R, and N are the three variables, and any change in one, two, or three, a contract change is observed.

P stands for principal amount is the value of money that is approved by the financial institution.

R is the rate of interest that is decided by the money lender.

N stands for the number of allotted years for the repayment of the loan.

You can illustrate and view how the formula is applicable.

The loan against the property is INR 20 lakh with an average rate of interest equal to 11 percent for a tenure of 5 years. Then,

Rate of interest = 11/100/12

Years converted to months, N = 5 years or 60 months.

EMI = [20,00,000 x 11/100/12 x (1+11/100/12)^60]/ [(1+11/100/12)^60-1] = INR 43,483.00.

For additional financial calculations, try our Interest Calculator to compute interest on savings, loans, or investments.

What Are the Basics of a Mortgage?

A mortgage is a loan used to purchase property, where the property itself serves as collateral. When you take out a mortgage, you borrow money from a lender, usually a bank, and agree to pay it back over a set period, typically 15 to 30 years.

The loan amount is repaid through monthly payments that include both principal (the amount borrowed) and interest (the cost of borrowing).

There are different types of mortgages, such as fixed-rate and adjustable-rate, each with varying interest rates and terms.

A down payment, often 20% of the property's value, is usually required upfront. If you fail to make payments, the lender has the right to foreclose on the property.

Understanding mortgage basics is essential for making informed decisions when purchasing a home or property.

Benefits of using the Loan Against Property Calculator:

Financial institutions provide loans against property by filling in the details in the property calculator. After that, you will get the equated monthly installment, EMI in a split second.

The property calculator enables you to balance your income and expenses which helps you save money for essential financial goals.

The mortgage loan calculators are made available online and by operating those you can save time and decide at what pace you must repay equated monthly installment, EMI on the loan credit.

Usually, it becomes important to understand how the repayments are broken down to complete the loan payment.

Loan against property calculators keeps you away from complex calculations and provides you instant solutions.

Good at providing simple solutions to complex calculations, & easy to operate.

You can change the value of the variables such as principal amount, total number of terms, and a calculator for an EMI that makes you feel comfortable while making repayments.

You can operate the mortgage loan calculator anytime (24 x 7) from anywhere.

You can obtain the complete breakup of the total payment from the Amortisation Schedule.

The above tabular column is an example of the payment of EMI that contains two main components, interest paid, principal paid, and the outstanding balance.

For a steady payment of EMI (INR 11894.97) for six years from 2023 to 2028 years, you will find the interest paid and principal paid components keep increasing from year on year (2023-2028)

Formula for Mortgage Calculator

A mortgage calculator helps you estimate your monthly home loan payments using a simple formula. The standard formula used is:

M = P[r(1+r)^n] / [(1+r)^n – 1]

Where:

M = Monthly payment

P = Principal loan amount

r = Monthly interest rate (annual rate divided by 12)

n = Total number of monthly payments

This formula takes into account the loan amount, interest rate, and loan term to give you an accurate monthly repayment figure.

Using a mortgage calculator saves time and helps in planning your finances better. It allows you to adjust values and instantly see how changes in loan term or interest rate affect your payment. This tool is especially helpful when comparing different loan offers.

It's fast, reliable, and easy to use, making it a must-have for anyone looking to buy a home or refinance their mortgage.

Key Features of Mortgage Calculator

A Mortgage Calculator is a powerful online tool designed to help users estimate their monthly home loan payments with ease.

One of its key features is real-time calculation, allowing users to instantly see how changes in loan amount, interest rate, or loan tenure affect their payments.

It offers a detailed payment breakdown, including principal and interest portions, making it easy to understand financial commitments.

The calculator also includes amortization schedules, which show how your loan is paid off over time. With customizable inputs, users can adjust figures based on their budget and needs.

Many calculators support prepayment and tax estimations, giving a clearer picture of total expenses. Simple to use and accessible from any device, a mortgage calculator helps users plan better, compare loan options, and make confident financial decisions.

It's an essential tool for homebuyers and property investors alike.

How to Calculate the EMI for Loan against Property?

You must insert the amount in the blanks by sliding the knob on the horizontal bar.

You will have to select the loan amount, interest rate, and tenure.

The EMI calculator shall display the EMI, the interest payable, and the total amount payable ( principal + interest)

Practical Illustration:

Enter the loan amount = INR 5,00,000.00 | Rate of Interest = 15%| Tenure = 5 years.

Then, in a little while, you will find the EMI calculator deriving the answers for you, and they are total amount = principal + interest (INR 7,13,697), interest payable (INR 2,13,697), and EMI (11,894).

How Can a Mortgage Loan Calculator Help?

Until your EMI payments are paid off, you will have to keep track of the repayments of the mortgage loan for a floating loan.

The Mortgage loan calculator helps you calculate the monthly payments and it outperforms the human mind.

You can estimate the mortgage loan and the calculator provides good estimates for financial planning that are more accurate and never end up in wrongdoing.

Mortgage loans on property keep on changing and each property is evaluated for loans differently. And the EMI calculators are designed to provide precise EMIs on mortgaged property.

Eligibility Criteria for Loan Against Property:

You must declare the total annual income.

To take a loan against property, you must have attained 21 years of age.

Your property should be evaluated before applying for a loan against the property.

You must be able to present financial documents related to the property.

Loan against property is provided to salaried class / self-employed individuals.

Applications of Mortgage Calculator

A mortgage calculator is a powerful tool that simplifies home loan planning and helps users make informed financial decisions.

One of its primary applications is estimating monthly mortgage payments by entering variables like loan amount, interest rate, and repayment term.

This helps prospective homebuyers determine affordability before applying for a loan.

It’s also widely used to compare different loan options, evaluate the impact of interest rate changes, and understand how much total interest will be paid over time.

Financial planners and real estate agents often use it to guide clients through various scenarios, making it easier to choose the best-fit mortgage product.

Additionally, a mortgage calculator can assist in planning for extra payments, showing how prepayments reduce loan tenure and interest costs.

Overall, it’s a must-have tool for anyone involved in buying, refinancing, or managing home loans—offering clarity, control, and confidence in every step of the process.

Advantages of Mortgage Calculator

A mortgage calculator offers several benefits that make home financing easier and more transparent. One of the biggest advantages is quick and accurate estimations of monthly payments based on the loan amount, interest rate, and tenure.

This helps users plan their budget more effectively before committing to a mortgage. It also allows potential buyers to compare different loan options and choose the most affordable one.

With features like amortization schedules, users gain insights into how much of their payment goes toward interest and principal over time.

Additionally, mortgage calculators often support extra payment and prepayment options, helping users understand how to save on interest.

Accessible anytime online, this tool saves time, avoids manual errors, and simplifies complex financial calculations.

Whether you're a first-time homebuyer or refinancing your loan, a mortgage calculator is an essential tool for making smart, informed decisions.

For more in-depth financial calculations, try our Financial Calculator to assist you with budgeting and financial planning.

Frequently Asked Questions

Q1: What is a Mortgage Calculator?

Ans: A Mortgage Calculator is an online tool that helps you estimate your monthly loan payments when buying a house. It calculates the amount you need to pay each month based on the loan amount, interest rate, and loan term.

Q2: How does a Mortgage Calculator work?

Ans: A Mortgage Calculator uses the following inputs to calculate your monthly payment:

Loan Amount: The total money you borrow from the lender.

Interest Rate: The annual interest charged on the loan.

Loan Term: The period to repay the loan, usually in years.

Down Payment: The initial amount you pay upfront.

Property Taxes and Insurance: Additional costs that may apply.

The tool applies a formula to provide an estimated monthly payment.

Q3: Why should I use a Mortgage Calculator?

Ans: Using a Mortgage Calculator helps you:

Plan your budget and understand your financial commitments.

Compare different loan options.

Estimate how much house you can afford.

Determine how changing interest rates or loan terms affect payments.

Q4: Can I compare different loan options with a mortgage calculator?

Ans:Yes! You can change the interest rate, loan amount, or tenure to compare different loan offers. This helps you pick the best option for your needs.

Q5: Does the calculator show the total cost of the loan?

Ans:Yes, most mortgage calculators show both your monthly payment and the total amount you will pay over the entire loan term, including interest.

Q6: Are taxes and insurance included in the Mortgage Calculator?

Ans:Standard Mortgage Calculators typically only estimate the principal and interest portions of your mortgage payment. However, some advanced calculators include estimates for property taxes and homeowners insurance, which are often part of your monthly mortgage payment.

Q7: Does a Mortgage Calculator include taxes and insurance?

Ans:Some mortgage calculators include estimates for property taxes, homeowners insurance, and mortgage insurance (if applicable). However, others focus only on the loan payments. Always check the settings of the calculator to ensure all relevant costs are included.

Q8: Can first-time homebuyers use a Mortgage Calculator?

Ans:Yes, a Mortgage Calculator is very helpful for first-time homebuyers. It provides a clear picture of how much they can afford to borrow and helps them make informed decisions.

Q9: Does the Mortgage Calculator consider property taxes and insurance?

Ans:A basic Mortgage Calculator only calculates the principal and interest payments. For a complete estimate that includes property taxes and insurance, look for a more advanced calculator or consult your lender.

Q10: Can I use the Mortgage Calculator for refinancing?

Ans:Yes, you can use the Mortgage Calculator to estimate payments for refinancing. Enter the new loan amount, interest rate, and term to see how much you can save with a refinance.

Q11: Is a Mortgage Calculator accurate?

Ans:Yes, it gives a good estimate based on the numbers you enter. But keep in mind, actual loan terms from banks or lenders may be slightly different. Always check with your lender for final details.