DATE OF RETIREMENT CALCULATOR

years, Months, Days

What is Date of Retirement Calculator?

Toolerz Date of Retirement Calculator is a free online financial tool designed to estimate the ideal age at which an individual can retire while maintaining financial security and achieving their retirement goals.

By inputting key financial information and retirement objectives, the calculator provides personalized recommendations for retirement age, taking into account factors such as life expectancy, savings, investments, and desired lifestyle.

How to Use

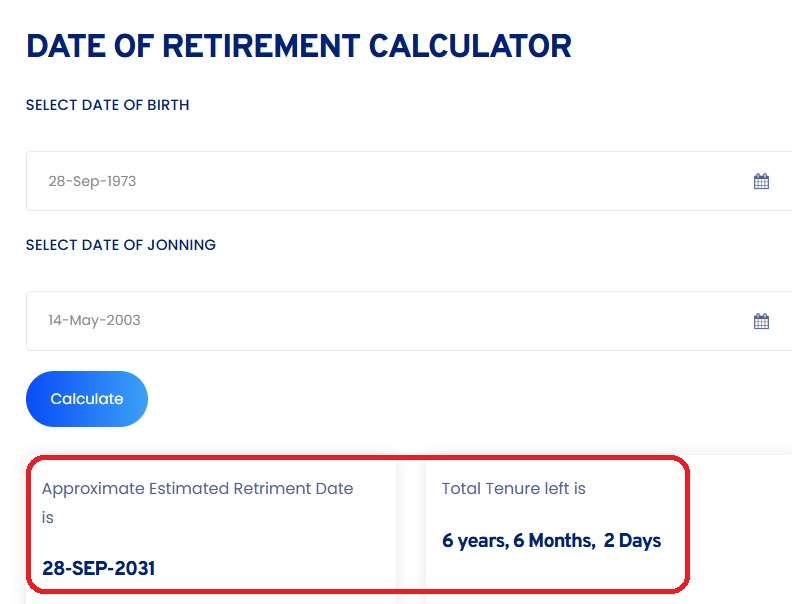

After visiting our tool's page, enter the following input data

- Date of Birth

- Date of Joining

After hitting the calculate button, our tool will display the date of retirement and the no. of days left for your retirement.

Benefits of Date of Retirement Calculator

A Date of Retirement Calculator is a valuable tool for employees planning their future. It helps you quickly determine your official retirement date based on your date of joining, age of retirement, and company or government rules.

One of the main benefits is accuracy it removes guesswork and provides a clear retirement timeline. This allows for better financial and personal planning, such as pension setup, savings goals, or travel plans after retirement.

The calculator is also easy to use. Just input your details, and it instantly shows your expected retirement date.

This is especially helpful for HR professionals, government employees, and private-sector workers.

By knowing your retirement date in advance, you can plan smartly and prepare for a smooth transition. It saves time, reduces confusion, and brings peace of mind about your future.

Date of Retirement Calculator at 60 Years:

For many individuals, the age of 60 is considered a common retirement age. In countries like India, where the retirement age for most government employees is 60 years, the Date of Retirement Calculator may suggest retiring at this age to maximize retirement benefits and pension schemes.

The decision to retire at 60 depends on individual choices, based on financial goals, health status, and personal preferences one may decide.

For better loan management, check out our Amortization Calculator to understand your loan payments over time.

Date of Retirement Calculator at 58 Years:

Some individuals choose to retire earlier, aiming for a more relaxed lifestyle or pursuing personal interests during retirement.

The Date of Retirement Calculator can accommodate such preferences by providing retirement age recommendations tailored to individual goals and financial situations.

Formula:

The formula used to develop our Date of Retirement Calculator is based on factors such as life expectancy, retirement savings, inflation rate, and expected investment returns.

The calculator takes into account the desired retirement income, the rate of return on investments, and the number of years of retirement expected.

Retirement Age in India, USA, and Canada:

In India, the retirement age varies depending on the sector and occupation.

For government employees, the retirement age is typically 60 years, while for private sector employees, it may range from 58 to 65 years, depending on company norms.

In the USA:

In the USA, the full retirement age for Social Security benefits ranges from 66 to 67 years, depending on the year of birth.

However, individuals can choose to retire earlier or later, with implications for their Social Security benefits and retirement income.

In Canada:

In Canada, the normal retirement age for Canada Pension Plan (CPP) benefits is 65 years.

Citizens can opt to receive reduced benefits as early as age 60 or delay receiving benefits until age 70, depending on their financial needs and retirement plans.

Which Retirement Calculator Is Most Accurate?

The accuracy of a retirement calculator largely depends on the inputs you provide and the features it offers.

The most accurate retirement calculators are those that allow customization, consider inflation, investment returns, expenses, and life expectancy.

Calculators offered by trusted financial institutions like Fidelity, Vanguard, and SmartAsset are highly rated due to their detailed assumptions and real-time updates.

An accurate retirement calculator should let you input your current savings, monthly contributions, expected retirement age, and future expenses.

Tools that also include tax calculations and different income sources (like pension or Social Security) offer a more realistic estimate.

However, no calculator can predict the future perfectly.

They serve as planning tools, not guarantees. For the best results, use a calculator that matches your country’s financial system and update your inputs regularly based on life changes.

Always combine tools with professional financial advice for optimal retirement planning.

Applications of Date of Retirement Calculator

A Date of Retirement Calculator is a practical tool used to determine the expected retirement date based on an individual’s date of birth and employment rules.

It is especially useful for employees, HR departments, and government officials to plan ahead with clarity and precision.

One of its main applications is in retirement planning, helping individuals estimate when they can retire and begin receiving benefits or pensions.

It aids financial planning, allowing users to prepare savings, investments, and post-retirement budgets well in advance.

For HR professionals, this tool simplifies workforce management by tracking upcoming retirements and planning smooth transitions. In government and public sectors, it ensures compliance with retirement age policies.

Easy to use and highly accurate, the Date of Retirement Calculator supports effective career planning, timely documentation, and stress-free retirement preparation, making it an essential resource for both employers and employees.

For more planning help, try our Payment Calculator to better manage post-retirement finances.

Conclusion of Using Date of Retirement Calculator

Using a date of retirement calculator provides a quick and accurate way to determine your expected retirement date based on your date of birth and the standard retirement age. It eliminates guesswork and helps with future financial and lifestyle planning.

This tool is especially useful for employees, HR professionals, and pension planners who need a reliable retirement timeline. By knowing your exact retirement date, you can better organize your savings, investments, and career goals.

The calculator is user-friendly and saves time by automating the entire process. Whether you’re planning early retirement or want to stay until the official age, this tool helps you stay informed and prepared. In short, a date of retirement calculator brings clarity and confidence to one of life’s most important milestones.

Advantages of Using a Date of Retirement Calculator

A date of retirement calculator is a useful tool that helps individuals plan their financial future with clarity. One of the main advantages is accuracy it provides the exact retirement date based on your date of birth and the retirement age set by your employer or government policy. This saves time and avoids manual errors in calculation.

It also aids in financial planning, helping users estimate how many working years they have left and how much they need to save. For employers, it assists in workforce management by projecting upcoming retirements.

The calculator is easy to use, requiring just a few inputs to get quick results. Whether you're planning early retirement or want to know your official date, this tool offers clarity, convenience, and confidence in decision-making. It's especially helpful for long-term goal setting and preparing a comfortable post-retirement life.

FAQs:

Q1: Why should I use a Date of Retirement Calculator?

Ans:A Date of Retirement Calculator helps you:

Plan your retirement timeline.

Estimate how many years you have left until retirement.

Prepare for financial and pension planning.

Q2: Can I customize my retirement age?

Ans: Yes, most calculators allow you to enter a custom retirement age based on your country's retirement rules or personal preferences.

Q3: Does the calculator consider early or late retirement?

Ans: Some advanced calculators let you choose early or delayed retirement options, adjusting the results accordingly.

Q4: Is the calculator suitable for all professions?

Ans: Yes, the calculator works for most people. However, if you work in a profession with a fixed retirement policy (like government jobs), make sure to use the official retirement age set by your department.

Q5: Is the tool free to use?

Ans: Yes, most online retirement date calculators are free and easy to use. You don’t need to sign up or download anything www.toolerz.com .

Q6: Can I use this tool for early retirement planning?

Ans: Yes, you can. Just enter the age you want to retire at instead of the official retirement age. The calculator will show you the retirement date based on your preferred age.

Q7: Why should I use a retirement date calculator?

Ans: It helps you to plan your savings, pension, and lifestyle more effectively by knowing exactly when you’ll stop working.

Q8: What is a Date of Retirement Calculator?

Ans: A Date of Retirement Calculator is an online tool that helps you find out the exact date when you will retire based on your date of birth and your organization’s retirement age policy.

Q9: How does the Date of Retirement Calculator work?

Ans: You just need to enter your date of birth and the official retirement age (for example, 60 or 65 years). The tool then calculates the date when you’ll reach that age and shows your retirement date.

Q10: Who can use the retirement calculator?

Ans: Anyone can use this tool—whether you're a government employee, private worker, or self-employed. It's especially helpful for those planning their finances or career path.

Q11: Is the date of retirement fixed?

Ans: It depends on your company’s policies and local laws, but the calculator gives an estimated date based on the info you provide.