GST CALCULATOR

What is GST Calculator?

Toolerz GST calculator is a free online tool that can be used to calculate the amount of GST applicable on transactions.

Goods and Service Tax (GST) is an indirect tax laid upon the citizens of India involved in businesses like trade, buyers, and sellers. It is the summation of Central and State indirect taxes.

Hence, every business that conducts its operations within and across the State will have to pay the goods and Service tax to the Income Tax Department under the GST.

With its growing online importance, the GST calculator is designed to compute the payable GST for a month or a quarter depending upon the amount. Thus, you can find customized GST calculators readily available online.

Advantages of GST Calculator

The GST calculator enables you to obtain the percentage-based GST rates of products. Depending on the amount, the calculator will provide you with the price of the product @gross or net level.

For every good and service of a product, the calculator shall define the exact breakup between CGST and SGST, thereby making the IGST calculation more precise.

How Should I Calculate GST?

Goods and Service Tax can be calculated in simple steps. If you understand the simple formula that is applied in the calculation then you can do it yourself. However, GST equals the multiplication of the taxable amount and GST rate. That means, GST = taxable amount X GST rate

In case you require CGST, SGST/UTGST then for CGST or SGST you will have to halve the total GST amount.

In case you obtain an amount that is GST inclusive, then to know the value of the GST you must apply the formula that states:

GST ( after subtracting amount) = GST ( added to amount)/(1 + GST rate/100)

Practical Example:

If GST including amount is INR 525 and GST rate is 5 percent then the value of GST shall be as follows:

GST ( after subtracting amount) = 525/(1+5/100) = 525/1.05 = 500

For financial planning, you may also find our Car Loan Calculator useful in determining your loan EMI and repayment details.

Applications of GST Calculator

A GST calculator is a handy tool that helps individuals and businesses quickly calculate Goods and Services Tax on various products and services.

One of its primary applications is determining the correct GST amount for billing and invoicing, ensuring compliance with tax regulations.

It’s especially useful for small business owners, shopkeepers, and online sellers who need to generate accurate tax-inclusive or tax-exclusive prices.

Another important use is during financial planning, where businesses can estimate tax liabilities and plan budgets more efficiently. GST calculators also help customers understand the final price they are paying, making shopping more transparent.

For accountants and tax professionals, it simplifies complex GST rate calculations and reduces manual errors. Whether you're calculating CGST, SGST, or IGST, a GST calculator saves time, enhances accuracy, and promotes tax compliance. Its ease of use and speed make it a vital tool in day-to-day business operations.

GST Calculator India

The percentage of GST levied on a product is independently valued in determining the applicable percentage of GST.

Items like milk, and wheat flour do not attract GST rates but earth elements like rough diamonds (.025 %), gold, and silver (3 %). Most of the finished goods are placed under the 5 %, 12%, 18% and are up by 28 %.

Items such as cars, tobacco, and cement, pan masala attract 28 % GST, and on these items, the IT department collects additional amounts in the form of Cess charges.

Some many goods/services have 0 % GST.

What is a Reverse GST Calculator

Reverse Charge in GST comes into play when the government specifies a recipient to pay an amount equivalent to the applicable GST on the product/service directly to them.

Reverse Charge Calculation:

If you purchase a goods worth INR 10000.00 from a trader you are made to pay GST on reverse charge at 18 percent. It comes to INR 10000 X 18 percent equals INR 1800.00.

If CGST & SGST are to be levied then INR 900.00 must be paid for each of them.

How Do I Determine the Inclusive GST Amount?

If you purchase a product or get a service from a trader/service provider then the total bill will contain the value of the product along with the applied GST.

Such products and services are called GST inclusive hence the trader seller/service provider shall not collect tax separately.

How Do I Determine the Exclusive GST Amount?

To determine the GST-exclusive amount on a purchased product or a service you must deduct the GST amount from the GST-inclusive amount.

It shall provide you with the GST-exclusive amount reflecting the value of product and services.

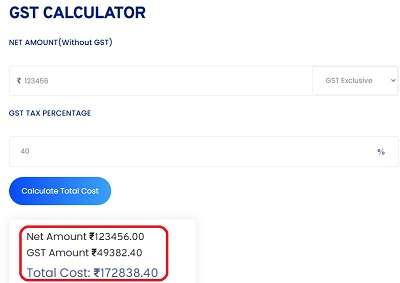

How to Use Online GST Calculator?

If you decide on what to calculate on the GST online calculator then you can proceed in the manner stated below.

You must select either GST inclusive or GST exclusive option then,

Enter the original amount of the product.

You must select the GST percentage levied on the product.

You should click the Calculate option button to obtain the final amount of the product.

Merits of Single Indirect Tax (GST) on Products & Services:

A unified tax structure on a product/service elevates the taxation to international standards.

Single Indirect tax ensures greater transparency between the manufacturer and the consumer.

GST implementation helps in avoiding double taxation on commercial goods.

It empowers India's GDP by providing high-quality products and services to the manufacturers and sellers communities.

Uniform taxation helps in the reduction of cost production for the manufacturers. Further, it enhances a competitive spirit amongst exporters.

With the introduction of GST, analytics proved to have a decrease in inflation and a decrease in tax liability.

Salient Features of Online GST Calculator:

GST is remitted by three communities, buyer, manufacturer, and retailer.

Each community has to remit depending on the tax laid on the kind of product and services rendered.

To obtain the goods and services, the buyer/manufacturer/seller will have to pay CGST/SGST/IGST.

Depending upon the category of the product purchased the GST department shall put the tax from 0%,3%,12%,18%, or 28% Most of the products and services fall into this ambit.

Important Note:

The GST calculator serves as a perfect guide in presenting the tax split component, on the products and services obtained by buyers, retailers, and manufacturers. It can be a tax component, CGST/SGST/IGST.

Presentation of GST formula for accurate

Before we enter into the calculation part of the GST, you must know what these taxes refer to and how they are calculated for the rendered products and services.

Central Goods and Services Tax, CGST, is the tax levied by the Central Government on the movement of goods within the state.

State Goods and Service Tax, SGST, is the tax levied by the state government on the movement of goods within the state. In such circumstances, any sale or supply of goods and services is liable to CGST/SGST and the revenue collected from goods/services shall be shared by the state and central equally.

Interstate Goods and Service Tax, IGST, is the tax component levied on the movement of goods between states (at an interstate level). The tax is collected by the central government and shared based on the destination of the goods.

Important Note:

Before the inception of the GST, these kinds of goods transactions were subjected to VAT, Central Excise, or Service Tax.

Why Choose our GST Calculator?

GST Calculator is a free tool designed by the IT department and a ready-to-use calculator to benefit the GST payers.

The GST is payable every month, quarterly depending on the chosen amount for payment. The GST calculator can fulfill the purpose of buyer, retailer, and manufacturer.

Indirect Taxes in India are levied on seeking goods and services in many ways, and to get rid of unnecessary complexities in tax payments, GST was put into force.

It is implemented to create a balance in the earnings of the Central and State governments.

Moreover, the Ministry of Finance has set GST with a view to simplify the tax regime.

It must be noted that the firms, and organizations that are placed under indirect taxes will have to pay GST under the GST Act. These firms/ organizations providing the products/services must hold a unique GSTIN.

The formula for GST Calculation:

A business, manufacturer, wholesale dealer, and retailer can calculate GST by implementing the following formula.

It can be calculated by the exclusion of the GST and the Inclusion of the GST.

GST (Exclusion):

GST Amount = Value of Supply x GST%)/100

You will be charged with a price that is equal to:

Amount of Price to be charged = Value of Supply + GST amount.

GST (Inclusion):

GST Amount =

Value of Supply - [ Value of Supply x {100/(100+GST%)}]

Example:

A product is supplied for INR 100 at a GST @ 18% then the GST amount = 100 - [100 x {100/(100+18%)}] = 100.

Illustration:

GST Payable by the Manufacturer/Retailer on Goods/Services

A manufacturer will have to pay GST for the production of the goods. A 10% tax will be laid on a good worth ₹2000.

The manufactured goods shall be delivered to the warehouse and are meant for labeling/packaging.

The warehouse adds ₹500 to the existing value of goods and then sells it to the retailer.

The retailer shall add to the advertisement cost of ₹600.

At all levels manufacturers, Warehouse dept, and retailers shall have to make tax liability payments to the government of India.

In the example, the manufacturer (INR 200.00): Warehouse (INR 50.00), and retailer (INR 100.00) shall be making a payment to the Govt. of India.

The manufacturer’s invoice total will be INR 2200.00 @ cost of INR 2000.00 + tax @10%.

Warehouse invoice total will be INR 2720.00 @ warehouse (labeling + packaging) + tax @10% ( INR 2500.00 + INR 200 )

The retailer invoice total shall be INR 3410.00 @ the retailer cost plus tax @10% ( INR 3100.00 + INR 310.00 )

Illustration: GST Paid by Manufacturer/Warehouse/Retailer

The below example explains various tax discounts/tax liability to Govt/invoice total at the manufacturer level and retailer level.

|

Particulars |

Cost |

Tax @10% |

Tax Liability ( Amount to be deposited to Govt. |

Invoice Total |

|

Manufacturer |

INR 2000.00 |

INR 200 |

INR 200 |

2200.00 |

|

Warehouse ( labeling + packaging) adds INR 500.00 |

INR2500.00 |

INR 220 |

INR 50 |

INR: 2720.00 |

|

Advertisement Amount Spend by Retailer INR 600.00 |

INR 3100.00 |

INR 310.00 |

INR 100 |

INR: 3410.00 |

How Do Buyers/Retailers/Manufacturers Benefit from GST Calculator?

You may belong to any of the aforesaid categories, such as buyer, retailer, or manufacturer, you can get from the calculator the actual tax split components.

You need not bother about the complex calculations that occur on the services you take in, the Goods and Services Tax department’s GST calculator shall define it.

The GST calculator helps you save time and enables you to obtain accurate tax implications on the goods and services procured.

The GST calculator presents the calculated breakup like CGST, SGST, and IGST in the most simplified form.

Benefits of GST Calculator

A GST calculator is a useful tool for individuals, businesses, and retailers to quickly compute Goods and Services Tax on products and services.

One of the major benefits is its ability to save time and reduce errors when calculating taxes, especially for multiple transactions.

It helps users determine both inclusive and exclusive GST amounts, making it easy to know the tax portion and net price of any product or service.

This is especially helpful for billing, invoicing, and accounting purposes.

GST calculators are user-friendly and support different GST slabs, such as 5%, 12%, 18%, and 28%, allowing quick switching between rates.

Some advanced versions even include state-specific tax rules for accurate calculations.

By simplifying complex tax math, a GST calculator ensures compliance, improves financial planning, and enhances overall business efficiency. It’s a smart tool for anyone dealing with GST in everyday transactions.

Additional Information on GST:

Earlier, the Central government had collected Central excise under various heads like excise, service tax, customs, and countervailing duty.

Similarly, the State government was collecting tax under the VAT, octroi, and Luxury tax and entertainment tax.

You must notice that the above-said info comes under the ambit of the GST now.

In July 2019, the GST was fixed under 4 tax slabs and they were 5%, 12%, 18% and 28%.

The GST Council has pulled in 1300 goods and 600 services under the newly established tax regime.

On What Basis Is GST Calculated?

Goods and Services Tax (GST) is calculated based on the transaction value of goods or services. This value includes the price of the item plus any extra costs like packaging, shipping, or other charges that are part of the sale.

GST is applied as a percentage of this total value, and the rate depends on the type of product or service—commonly 5%, 12%, 18%, or 28%.

For example, if you buy a product worth ₹1,000 with 18% GST, the GST amount will be ₹180, making the total ₹1,180.

It's important to note that GST is a destination-based tax, meaning it is collected in the state where the goods or services are consumed.

Businesses must also consider whether Central GST (CGST), State GST (SGST), or Integrated GST (IGST) applies, depending on whether the transaction is within a state or between states.

Key Goods Tax Modifications Under GST Regime

Food and beverages have been placed under a single slab, and the governing tax regime is 5%, 12%, and 18%.

Daily use household goods are brought under one tax slab:

Household items like toothpaste, and hair oil that were attracting 28% will be reduced to 18% only.

Eatables like sweets will be taxable at @5%.

Power industries are working hard for renewable energies and hence the government has reduced the tax cut on coal from 11.69% to 5%.

All educational Items shall from now on be 12% a sharp decline from the 28% tax earlier.

While managing your finances, you might also find our Ideal Weight Calculator helpful for maintaining a healthy lifestyle.

Conclusion of Using GST Calculator

Using a GST calculator makes calculating Goods and Services Tax easy and accurate. It helps businesses and individuals quickly find the GST amount on any product or service, saving time and reducing errors.

This tool is especially useful for billing, invoicing, and financial planning. With a GST calculator, you can easily determine the total price including tax or the base price before tax. It supports better budgeting and compliance with tax regulations.

Overall, a GST calculator simplifies tax calculations, improves accuracy, and helps users manage their finances more efficiently. Whether you are a business owner or a consumer, using a GST calculator ensures you stay informed and organized when dealing with taxes.

Advantages of Using GST Calculator

Using a GST calculator offers several advantages for both businesses and individuals. It simplifies the process of calculating the Goods and Services Tax (GST) on products and services, saving time and reducing errors.

With a GST calculator, you can quickly determine the exact tax amount, making billing and invoicing more accurate. This tool is especially helpful for small business owners who may not have advanced accounting knowledge.

Additionally, a GST calculator helps in understanding the final price of goods after tax, aiding better financial planning.

It also supports compliance by ensuring correct GST calculations, which is essential to avoid penalties. Overall, using a GST calculator enhances efficiency, accuracy, and transparency in tax calculations, making it a valuable tool for smooth financial management.

Frequently Asked Questions

Q1: What is a GST Calculator?

Ans: A GST Calculator is an online tool that helps businesses and individuals quickly calculate the Goods and Services Tax (GST) on a product or service. It provides accurate GST-inclusive and GST-exclusive prices, saving time and effort in manual calculations.

Q2: What are the current GST rates in India?

Ans: India has four main GST slabs:

5% – Essential goods (e.g., household items)

12% – Processed food, medicines, etc.

18% – Electronics, restaurants, etc.

28% – Luxury goods (e.g., cars, air conditioners)

Q3: Can I use the GST Calculator for reverse calculation?

Ans: Yes, you can use the calculator to find the pre-GST price if you only have the final price including GST.

Q4: How do I use a GST Calculator?

Ans: You just need to enter the original amount and select the GST rate (like 5%, 12%, 18%, or 28%). The calculator will show you the tax amount and the total price with GST included.

Q5: Is the GST Calculator free to use?

Ans: Yes, most GST calculators are free and available online. You don’t need to register or pay to use them www.toolerz.com .

Q6: Why should I use a GST Calculator?

Ans: A GST Calculator saves time and removes confusion. It helps you accurately calculate taxes for bills, invoices, and purchases without doing manual math.

Q7: Can a GST calculator help with GST refund calculations?

Ans: While a GST calculator can help you calculate the tax you owe, it typically does not handle GST refunds. However, it can help you understand how much you’ve paid and whether any GST credits or adjustments might be necessary when filing your GST returns.

Q8: What GST rates can I calculate using this tool?

Ans: GST rates in India typically range from 5%, 12%, 18%, and 28% depending on the product or service. Most calculators let you choose the correct rate for accurate results.

Q9: Can I calculate GST for both inclusive and exclusive prices?

Ans: Yes, most GST calculators allow you to calculate GST for both exclusive and inclusive price types. If your price includes GST, the tool will help you separate the tax portion.

Q10: Can I use the GST Calculator for services as well as products?

Ans: Yes, the GST Calculator works for both products and services. Just make sure to apply the correct GST rate based on the nature of the product or service.

Q11:Do I need to download anything to use a GST calculator?

Ans: No, most GST calculators are online and work directly on your browser. No download or sign-up is needed.