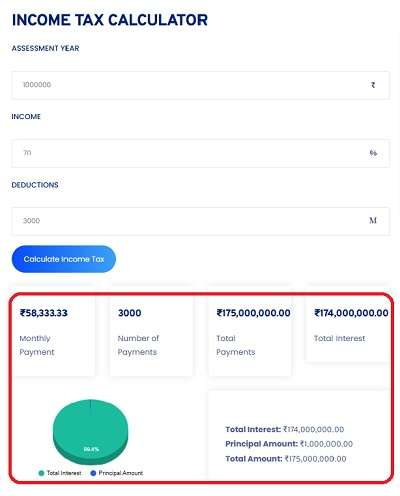

INCOME TAX CALCULATOR

Online Income Tax Calculator

The income tax department has released an online income tax calculator. It contains a user-friendly module interfaced to form a complete picture of taxation filed by the end of every financial year.

It is developed for all categories of individuals, and they can be salary classed (government/non-government), & self-employed.

Our Toolerz technical team also developed a similar tool which is more user-friendly and free to use. This tool can be helpful to those who want to calculate their estimated income tax for the financial year.

What is an Income-tax Calculator?

It is an online tool that lets you know how much tax you have to pay either under the old tax regime or the new tax regime.

The calculator provides a general format. and you will have to fill in the details in the blanks.

You are expected to provide details such as exemptions, deductions, and annual income and fill in the info on rent, home loans, EMIs, interest on education loans, and tuition fees that fall under the expenses.

Further, you are expected to provide information on tax-saving investments.

After you have entered the essential information in the respective blanks correctly, by pressing the computational button, the calculator shall provide the results.

The result will include the summation of the complete payable tax by the individual.

Income Tax Calculator AY 2023-24 & AY 2024-25

Nirmala Sitaraman, The Union Minister for Finance and Corporate Affairs has made five major announcements to benefit the salaried class/pensioners in the new tax regime, applicable from (AY 2023-2024) onwards & for the assessment year (AY 2024-2025).

The income tax department has given the choice to individuals to opt in opting the old regime or the new regime.

Once you opt for a regime, you will have to follow it without any further changes.

Below you will find:

The important changes that have been brought about in the new regime, and the tabular comparison between the old/new regime.

More important is the way to calculate the income tax, be it an old regime/new regime.

Income Tax Calculation for the Salaried

Income tax calculation for salaried individuals involves evaluating their total income and applicable deductions under the income tax rules.

The process starts with identifying the gross salary, which includes basic pay, HRA, bonuses, and other allowances. From this, you subtract exemptions like HRA (if eligible) and deductions under sections like 80C, 80D, etc.

Once deductions are applied, the taxable income is calculated. Based on this amount, tax is computed as per the income tax slabs applicable for the financial year.

Salaried employees can choose between the old tax regime, which allows various exemptions and deductions, or the new tax regime, which offers lower tax rates but fewer exemptions.

Using an online income tax calculator simplifies the process by giving a quick estimate of your tax liability.

This helps in better financial planning, avoiding surprises during tax season, and ensuring timely tax filing.

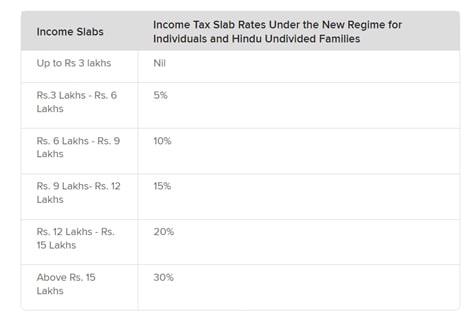

Income Tax Calculator New Regime:

To begin with, the new tax cut regime has made several changes that would benefit you from being a middle-class person. Let us look at the new tax regime:

Income tax shall apply to persons having an income above 7 lakhs

The Department of Income Tax has increased the tax exemption limit to INR 3.0 lakh.

Major Relief to All Taxpayers:

The income tax department wants you to pay only INR 45,000.00 tax against the annual income of INR 9.0 lakhs. Here, (the taxable income is INR 300000: the tax rate is 15%).

You will be saving INR 65,000.00 when compared to the old regime.

An individual with an income of INR 15 lakhs will have to pay only 10% or INR 1.5 lakh. Earlier, the same individual was made to pay 30 percent, and the new tax regime has brought a tax reduction of 20 percent, for an existing liability of INR 1,87,500.00.

The standard tax deduction has been extended to benefit the salaried class and pensioners.

In the new tax regime, the maximum tax rate replaces 74 percent by 39 percent.

You can notice a reduction in the highest surcharge rate.

For non-government salaried employees, the income tax department has provided an extension of the limit of tax exemption on the leave encashment on their retirement up to 25 lakhs.

Important Note:

The old tax regime’s tax structure has four income-tax slabs and the new tax regime has been reduced to Six income-tax slabs.

From 2023 onwards, the new tax regime shall be applicable by default yet an individual can continue to choose the old tax regime to avail those benefits.

Do you belong to a salaried class? Then, you should know how to calculate income tax.

For better financial planning, you may also want to check out our Interest Calculator to estimate returns on savings and investments.

Gross Taxable Income:

To calculate the gross taxable income, you will have to arrive at net salary and for that, you will have to calculate gross salary and subtract it from the standard deductions such as leave travel allowance, and house rent allowance.

Add the net salary with other sources of income such as capital gains from the investments, rental income, and interest income and then it becomes Gross Taxable Income.

Net Salary = Gross Salary - HRA - LTA - Standard Deductions,

Then, calculate Gross Taxable Income as:

Gross Taxable Income = (Net salary + Income from other Sources)

Total Tax Benefits in India:

Tax benefits are obtained by investing in a tax saving investment to seek an exemption.

You can reduce the taxable earnings by making tax saving options such as Public Provident Fund, Section 80C, Equity Linked & Saving Scheme ( ELSS).

Total Tax Benefits = (Health Insurance Premium + Home Loan Interest + Saving Account Interest + Investment under 80C + Others)

Net Taxable Income:

Net taxable income can be deduced by subtracting total tax benefits from the gross taxable income.

Net taxable income = (Gross taxable income – total tax benefits)

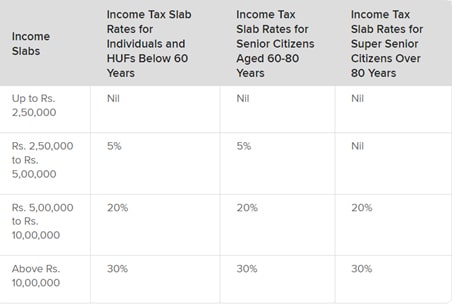

Total Tax Liability (Old Regime):

Under Section 87A, you will get a rebate of INR 12,500.00 provided your total taxable income is less than INR 500,000.

For a taxable income above INR 500,00.00, the taxable rate will be 20%, and for a taxable income above INR 100,000.00, the taxable rate will be 30%.

In addition, the income tax shall impose an education cess & health tax of 4% on the taxable income. Therefore total tax liability will be total taxable income + ( 4% on the taxable income)

You will be levied with a surcharge on the income earned and the income slab (for income beyond INR 50,00,000 and up to INR 1,00,00,000, will be 10%)

The surcharge for an income earned between INR 1 crore and INR 2 crore will be 15%.

The surcharge for an income earned between INR 2 crore and INR 5 crore will be 25%.

The surcharge for an income earned between INR 5 crore and INR 10 crore will be 37%.

The surcharge for an income earned beyond INR 10 crore will be 37%.

New Tax Regime:

According to the new tax regime, deductions/exemptions like HRA, and LTA would be taxable.

The income tax department shall not provide tax benefits by

If you are going for the new tax regime, the various tax-saving instruments.

It means, your entire income shall fall in the purview of the income tax.

Income Tax Slab Under New Regime:

Income Tax Slab Under Old Regime:

You can also try our Amortization Calculator to manage your loan repayment schedules effectively.

How is Income Tax Deducted?

Income tax is deducted from your salary through a process called Tax Deducted at Source (TDS). Your employer calculates the tax based on your total annual income, considering the current income tax slabs.

They also account for any investments or deductions you declare under sections like 80C, 80D, or home loan interest.

The total estimated tax is then divided over 12 months and deducted monthly from your salary.

If you don’t submit proof of tax-saving investments on time, your employer may deduct more tax. At the end of the financial year, you can file an income tax return (ITR) to claim refunds if excess tax was paid.

Understanding how income tax is deducted helps you manage your finances better and save more through smart planning.

Applications of Income Tax Calculator

An Income Tax Calculator is an essential tool that helps individuals calculate their tax liabilities quickly and accurately.

It simplifies the process by considering various factors such as income, deductions, exemptions, and applicable tax slabs.

One of the primary applications of the Income Tax Calculator is to assist taxpayers in determining their tax obligations before filing returns.

By inputting their income details, individuals can see how much tax they owe and plan their finances accordingly.

This tool also helps in tax planning by showing the impact of various exemptions and deductions, enabling users to optimize their tax savings.

For salaried individuals, business owners, and freelancers, this tool streamlines the often complicated tax filing process.

It also ensures compliance with tax laws, helping users avoid errors or missed deductions. With its user-friendly interface, the Income Tax Calculator saves time and reduces the stress of calculating taxes manually.

Conclusion of Using Income Tax Calculator

Using an income tax calculator offers a quick, reliable, and hassle-free way to estimate your tax liability. It helps individuals plan their finances better by giving a clear picture of how much tax they owe based on their income, deductions, and applicable tax slabs. With just a few inputs, the calculator provides accurate results, reducing the chances of manual errors.

This tool is especially helpful for salaried employees, freelancers, and small business owners who want to stay tax-compliant and avoid surprises during tax season. It also helps in understanding how deductions and exemptions can reduce taxable income.

In conclusion, an income tax calculator is an essential tool for smart financial planning. It saves time, boosts accuracy, and empowers users to make informed financial decisions. Whether you're filing taxes or budgeting for the year, this calculator simplifies the process with ease and efficiency.

Frequently Asked Questions (FAQs)

Here are some of the important most asked questions about our income tax calculator.

Q1: How do I use the Toolerz income tax calculator?

Ans: Using our income tax calculator is simple:

Input Your Income: Enter your total annual income from all sources, including salary, bonuses, investments, and other earnings.

Enter Deductions and Credits: Provide information about any deductions and tax credits you are eligible for, such as mortgage interest, charitable donations, education expenses, and more.

Review and Calculate: Once all relevant information is entered, click the calculate button.

The calculator will provide an estimate of your total tax liability, your effective tax rate, and any potential refunds or additional taxes owed.

Q2: Is this income tax calculator free to use?

Ans: Yes, our income tax calculator is completely free to use. There are no hidden fees or charges. Not only for personal use, we also provide free services to enterprises www.toolerz.com .

Q3: How accurate is the Toolerz income tax calculator?

Ans: Our income tax calculator uses the latest tax laws and regulations to provide accurate results.

Q4: Can the income tax calculator handle different types of income?

Ans: Yes, our income tax calculator can handle various types of income, including salaries, wages, bonuses, investment income, rental income, and more.

Q5: Does the income tax calculator account for tax credits?

Ans: Absolutely. Our calculator includes fields for various tax credits, such as the Earned Income Tax Credit (EITC), Child Tax Credit, education credits, and more.

Q6: How often is the income tax calculator updated?

Ans: We regularly update our income tax calculator to reflect the latest changes in tax laws and regulations. This tool will get updated every 15 days based on the new regulations.

Q7: Can the income tax calculator be used by self-employed individuals?

Ans: Yes, self-employed individuals can use our income tax calculator. It includes fields for business income, expenses, and other relevant information, allowing self-employed users to estimate their tax liabilities accurately.

Q8: Is the income tax calculator secure?

Ans: Yes, we prioritize user privacy and data security. Our calculator does not store any personal information, and all data entered is used solely for the purpose of providing an accurate tax estimate.

Q9: Can I save my calculations for future reference?

Ans: Currently, our calculator does not offer a save function. However, you can print or screenshot your results for future reference.

We recommend noting down your estimates and any important information for your records.

Q10: Does the income tax calculator provide guidance on filing taxes?

Ans: Yes, by using our income tax calculator you can get a clear idea of filing taxes.

Q11: Who can use an Income Tax Calculator?

Ans: Anyone earning an income in a financial year, including:

Salaried individuals

Self-employed professionals

Business owners

Pensioners

It is especially useful for taxpayers under the old or new tax regimes.

Q12: Can I use the calculator for both old and new tax regimes?

Ans:Yes, most income tax calculators allow you to compare tax amounts under both old and new regimes. This helps you decide which one saves more tax.

Q13: Why should I use an Income Tax Calculator?

Ans:Using an Income Tax Calculator allows you to quickly estimate your tax obligations. It helps you plan your finances and avoid surprises when it’s time to file your tax returns.

Q14: Is the calculator updated with the latest tax rules?

Ans:Good calculators are updated every year with the latest tax slabs and rules announced in the budget. Always use a trusted tool for accurate results.

Q15:Can I use the calculator for tax planning in advance?

Ans:Yes, you can use the calculator before the financial year ends to plan investments, claim deductions, and reduce your tax liability in a smart and legal way.