LIC LOAN CALCULATOR

What is Toolerz LIC Loan Calculator?

Toolerz LIC Loan Calculator is an online tool that helps policyholders estimate the loan amount they can borrow against their LIC policy, the interest rate applicable, the repayment period, and the monthly EMI (Equated Monthly Installment).

By using our LIC Loan Calculator, you get a clear understanding of how much loan you can avail of against your LIC policy, how much interest you will have to pay, and how long it will take to repay the loan based on the policy terms.

LIC Loan Calculation for Home

If you have taken a home loan from LIC Housing Finance, our LIC Loan Calculator can also help you estimate your EMI.

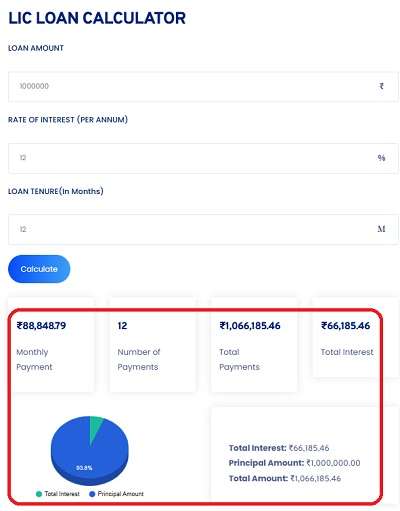

The inputs required include the loan amount, interest rate, and tenure. The tool will display the total repayment amount, total interest payable, and the EMI that you need to pay every month.

Loan Calculation for LIC Policies

When you take a loan against your LIC policy, the loan amount is typically a percentage of the surrender value of your policy.

Our LIC Loan Calculator simplifies this calculation by taking into account your policy value and showing you how much you can borrow.

Documents Required for LIC Policy Loan

To apply for a loan against your LIC policy, you typically need the following documents:

- A duly filled loan application form

- Original policy document

- Identification proof (Aadhaar card, PAN card, etc.)

- Address proof

- A recent passport-sized photograph

- A canceled check or bank statement (for disbursement)

If you're looking to maintain a healthy lifestyle, try our BMI Calculator to check if your weight is in a healthy range.

Key Features of LIC Loan Calculator

The LIC Loan Calculator is a valuable tool designed to help policyholders estimate loan amounts and repayment details against their LIC policies.

One of its key features is real-time calculation, allowing users to quickly determine the eligible loan amount based on their policy's surrender value.

It provides clear breakdowns of interest rates, EMIs, and repayment tenure, ensuring better financial clarity.

The calculator also includes easy input options, such as policy number, premium paid, and policy term, making it user-friendly for both new and experienced users.

With instant results and zero complexity, users can plan their finances efficiently without manual calculations.

Additionally, it supports flexibility in loan terms, enabling comparison of multiple scenarios to choose the best option.

Whether you're considering a short-term loan or long-term borrowing, the LIC Loan Calculator ensures informed and hassle-free decision-making. It’s a smart companion for managing loans against your life insurance policy.

How is LIC Loan Value Calculated?

The loan value is calculated based on the surrender value of your policy.

LIC generally provides loans up to 90% of the surrender value for paid-up policies and up to 85% for policies that are still under premium payment.

The formula used for calculating the loan value is:

Loan Value = Surrender Value × Loan Percentage

Where the loan percentage is usually between 80-90%.

Benefits of LIC Loan Calculator

A LIC loan calculator is a helpful online tool that allows you to estimate your loan amount, interest payable, and EMIs when taking a loan against your LIC policy.

One of the biggest advantages is its ease of use—just enter a few basic details like policy value, loan amount, and tenure, and get instant results.

This tool helps in better financial planning, allowing you to compare options and choose a repayment plan that fits your budget.

It also saves time by removing the need for manual calculations or visiting a branch for every query.

Another key benefit is transparency. You get a clear view of how much interest you'll pay and how it affects your finances.

Whether you're planning for education, emergencies, or other needs, the LIC loan calculator ensures quick, accurate, and stress-free loan management. It’s a smart way to stay informed and in control.

What is the LIC Loan Interest Rate?

The interest rate on loans against LIC policies is relatively low, usually ranging from 9% to 10%.

This rate may vary slightly based on the policy type and the duration of the loan.

Can I Take a Loan on LIC Policy?

Yes, you can take a loan against your LIC policy provided your policy has acquired a surrender value.

The documents required include:

- Policy bond

- Loan application form

- KYC documents (Aadhaar, PAN, etc.)

- A canceled check for disbursement purposes

For better savings insights, check out our FD Calculator to compare fixed deposit returns.

What Are the Disadvantages of LIC Housing Loan?

While LIC Housing Finance offers competitive home loan options, there are a few disadvantages to consider.

One of the main concerns is the processing speed, which can be slower compared to private banks. The documentation process may also be more rigid and time-consuming.

Another drawback is the limited flexibility in interest rates. LIC Housing often offers fixed or semi-fixed interest plans, which may not be ideal when market rates fall.

Some customers also report higher processing fees and less responsive customer service, especially during follow-ups or for balance transfers.

In addition, online support and digital tools may not be as advanced or user-friendly as those offered by newer private lenders. These factors can lead to delays or inconvenience in managing your loan efficiently.

Before choosing a home loan, it's important to compare options from different lenders based on interest rates, service, and repayment flexibility.

Applications of LIC Loan Calculator

The LIC Loan Calculator is a handy online tool that helps policyholders estimate the loan amount they can avail against their Life Insurance Corporation (LIC) policy.

One of its key applications is providing clarity on loan eligibility, helping users make informed financial decisions without visiting a branch.

It allows quick calculation of interest payable, total loan value, and repayment schedules based on the policy's surrender value.

This makes it easier for users to plan finances, especially during emergencies or short-term fund requirements.

The calculator also supports comparison between different policy loans, helping borrowers choose the most beneficial option.

Additionally, it aids in avoiding over-borrowing by offering a realistic picture of loan affordability.

Overall, the LIC Loan Calculator streamlines the borrowing process, saving time and effort while promoting responsible financial planning.

It's a valuable tool for both existing and new LIC policyholders seeking hassle-free loan management.

Advantages of LIC Loan Calculator

The LIC Loan Calculator offers several advantages for policyholders looking to borrow against their life insurance policies.

One of the main benefits is its speed and convenience—users can instantly calculate their eligible loan amount without complex paperwork.

It simplifies financial planning by providing accurate details about interest rates, repayment tenure, and EMI amounts.

The calculator is especially helpful in comparing different loan scenarios, allowing users to make informed decisions.

It also helps reduce the risk of overborrowing, as it’s based on the policy’s surrender value. With its user-friendly interface and real-time results, the LIC Loan Calculator saves time and eliminates guesswork.

Whether you're planning a short-term need or a long-term financial goal, this tool ensures clarity and confidence in your borrowing process.

It’s an essential resource for anyone looking to manage loans efficiently and stay in control of their finances.

Frequently Asked Questions

Q1. What is the maximum loan I can avail of using the LIC Loan Calculator?

Ans: The maximum loan amount is generally up to 90% of the policy's surrender value.

Q2. Does the loan calculation differ for different policies?

Ans: Yes, the calculation can vary depending on the policy type and surrender value.

Q3. Can I use the LIC Loan Calculator for all LIC policies?

Ans: Yes, the tool works for most traditional life insurance policies that have acquired a surrender value www.toolerz.com .

Q4. Is the calculator accurate for current interest rates?

Ans: Yes, the calculator uses up-to-date interest rates, ensuring accuracy.

Q5. How do I know the surrender value of my policy?

Ans: You can check your surrender value in your policy documents or by contacting your LIC agent.

Q6. Can I prepay my loan calculated through the LIC Loan Calculator?

Ans: Yes, LIC allows prepayment of loans with or without prepayment charges depending on the policy terms.

Q7. Does the calculator calculates loan processing fees?

Ans: Our calculator does not include processing fees, but you can adjust the loan amount to account for them.

Q8. Can I take multiple loans on the same policy?

Ans: Yes, as long as you have enough surrender value remaining.

Q9. What happens if I default on my loan?

Ans: LIC may adjust the outstanding loan amount against the policy benefits.

Q10. How do I adjust the loan tenure in the calculator?

Ans: You can manually input the desired loan tenure in the calculator to see how it affects your repayment.

Q11. Is the interest rate fixed throughout the loan tenure?

Ans: Usually, the interest rate remains fixed unless LIC revises its loan policies.

Q12. Can I use the LIC Loan Calculator for loans on endowment policies?

Ans: Yes, the calculator works for endowment policies as well.

Q13. Does the calculator consider the grace period for loan repayment?

Ans: No, the grace period is determined by LIC, not calculated by the tool.

Q14. Can I apply for a loan against my LIC policy?

Ans: Yes, if you have a LIC policy with a surrender value, you can apply for a loan. The loan amount is typically a percentage of the surrender value of your policy.

Q15. Why should I use an LIC loan calculator?

Ans: Using an LIC loan calculator helps you plan your loan better. You get a clear idea of how much you can borrow, the interest cost, and the repayment amount—without any guesswork.

Q16. Can I change the loan amount and term in the LIC Loan Calculator?

Ans: Yes, you can easily change the loan amount, interest rate, or repayment time to see different EMI options. It helps you choose a loan plan that fits your needs.

Q17. What is an LIC Loan Calculator?

Ans: An LIC Loan Calculator is a free online tool that helps you estimate your loan amount, interest, and repayment when you take a loan against your LIC policy. It helps you plan your loan in a better and smarter way.

Q18. How does the LIC Loan Calculator work?

Ans: You enter details like your LIC policy amount, loan tenure, and interest rate. The calculator then shows the loan amount available and monthly repayment.