SALES TAX CALCULATOR

%

What is Toolerz Sales Tax Calculator

Toolerz Sales Tax Calculator calculates the sales tax rates in your state. Use this user-friendly free tool to reveal your total estimated tax rate

Sales tax is applied on every good and service that you obtain from the commercials and the calculation of the sales tax is simple, and the formula is presented below.

Total Sales Tax = Cost of item x Sales tax rate

How to Use Toolerz Sales Tax Calculator?

If you are an Indian and want to calculate the sales tax on your product, you can utilize this free tool by foolowing simple steps.

Step 1: Go to the Sales Tax Calculator page here

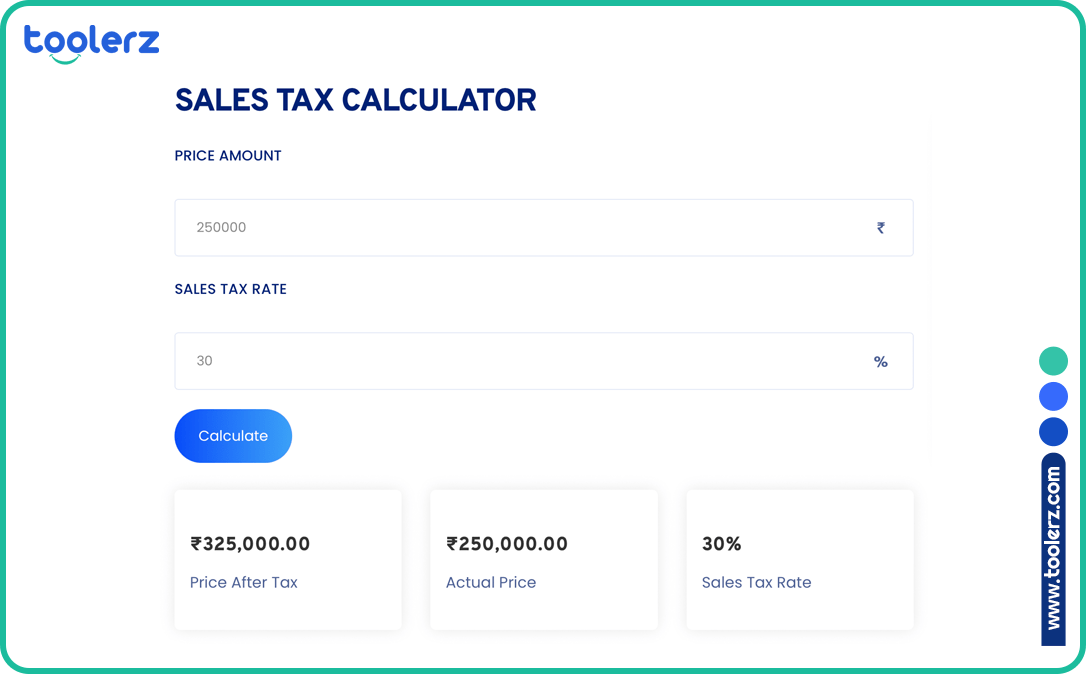

Step 2: After entering the page, enter the input parameters like Basic Amount of the product and the Sales Tax Rate. Below image is for your reference.

Step 3: Hit the Calculate Button to get the parameters like Total Amount, Basic Price, and the Tax Rate.

Benefits of Sales Tax Calculator

A Sales Tax Calculator provides several benefits, particularly for businesses and consumers. It helps businesses automatically calculate sales tax, ensuring that they apply the correct rates to transactions without errors.

This feature is especially useful for companies operating in multiple states or regions, where tax rates vary.

For consumers, it offers the convenience of estimating the total cost of products, helping them plan and budget effectively. Businesses can also use the tool to ensure compliance with tax laws, avoiding costly mistakes and penalties.

The calculator’s time-saving nature allows businesses to quickly calculate sales tax without needing to manually check rates or do complicated math.

It also helps in maintaining accuracy and improving customer satisfaction, as they receive clear, transparent pricing. Overall, the Sales Tax Calculator simplifies financial processes and supports smooth, efficient transactions for both businesses and customers.

Illustration:

A person purchases a box of sweets costing INR 200.00 and the sales tax component of 10 percent. The total sale tax paid by the person is ( 200 x .10) = 20.

The person makes a payment of INR 20.00 on the purchased box of sweets.

Points to be Remembered for Calculating the Sales Tax:

Every State has a specific sales tax and at times differs from city to city as well.

It is calculated as a percentage of the complete bill for the goods & services.

The final bill on which the sales tax is calculated is the addition of the prices of multiple items.

Violation of Sales Tax Rules

People may avoid the sales tax payment at the Central Board of Direct Taxes. And below are the most possible ways in which one can exit the payment of it.

A person may furnish false and misleading information in the forms.

A person should follow the rules and regulations as mentioned in the CST Act for applying for a registration of a firm, nongovernment company, business, or corporation.

The registered firm/company/corporation must follow all the essential norms that are created in the CST Act.

The person purchasing goods/services at discounted rates should not misappropriate the cause of it.

A businessman cannot impersonate a dealer or present a misappropriate projection as a dealer.

A business should be registered to apply sales tax on the bill/invoice and this is considered a violation otherwise.

A wholesale dealer or retailer must maintain proper statements about the procured goods and services.

Central Board of Direct Taxes

Central Board of Direct Taxes is under the purview of the Ministry of Finance and functions under the Department of Revenue.

It came into existence under the Central Board of Revenue Act of 1963.

Composition of Central Board of Direct Taxes:

The board composes the members in the order of:

Chairman

Member (Income Tax)

Member (Legislation and Computerisation)

Member (Revenue)

Member (Personnel and Vigilance)

Member (Investigation)

Member (Audit and Judicial)

Salient Features of Central Board of Direct Taxes:

The Central Board is concerned with the levy and collection of direct taxes in India.

The Office of Direct Taxes is involved in framing the direct taxes.

The Central Board of Direct Taxes looks after the administrative activities of direct tax laws by associating with the Income Tax Department.

The Central Board takes the initiative in the process and the investigation of the registered complaints on tax evasion.

For financial planning, check out our FD Calculator to estimate your fixed deposit returns effortlessly.

Sales Tax in India

Sales tax is an indirect tax collected by the seller while selling the goods/services or exchanging a taxable good.

The seller credits the sales tax collected from the buyer into the government exchequer.

The decision of tax levied on a product is in the hands of the State government and it is at this level ( state) that the government carves taxation policy as per the need.

Important Note:

Although Goods and Services Tax, GST, replaced Sales Tax on July 01, 2017, the article highlights how sales tax existed at the Centre/State level earlier.

Different kinds of taxes were levied under different categories such as manufacturers, wholesale dealers, retail dealers, and users, and value-added tax on every kind of sale VAT existed as chosen by the State governments.

Taxation Around the Globe:

Around the globe, governments of various nations have designed taxation systems that broadly include five kinds of taxes under the sales tax ambit.

They are Manufacturer’s sales tax, value-added tax, Retail sales tax, use tax, & wholesale sales tax.

Governments need revenue to build and develop nations, and the best form of revenue generation is through tax collections on various segments like manufacturing, Service Providers, and businesses in the fields of infrastructure, technology, education, etc.

In India, the Central Union Government instructs the Center and state government of every state to pay taxes that fit the developmental needs.

Sale Taxes in Detail:

On the sale of goods and services, the retailer provides a bill/invoice to the consumer that contains the tax component and the consumer (buyer) makes the payment of the tax component, known to be retail sales tax.

The manufacturer of a product/goods will have to pay the levied sales tax.

The product/goods pass through an intermediary distribution dealer and hence, sales tax has to be paid by the wholesale dealer.

Certain classes of consumer goods that are sold by the vendors, do not fall under the tax jurisdiction, for that users (buyers) will have to pay user tax.

Value Added Tax: It is an additional tax put on the retailer on every sale of the goods/services by the Indian state governments.

Which State Has the Lowest Sales Tax?

When it comes to sales tax in the United States, some states offer a more budget-friendly shopping experience. As of recent data, several states stand out for having the lowest or even no state-level sales tax.

The state with the absolute lowest is Delaware, which has no state sales tax at all. This makes it a popular destination for tax-free shopping, especially for big-ticket items.

Other states with low or no sales tax include Montana, New Hampshire, and Oregon, which also do not impose a state sales tax.

Alaska technically has no state sales tax but allows local governments to charge their own.

Shopping in these states can lead to significant savings, especially for businesses or individuals making large purchases.

Knowing where sales tax is lowest can be helpful for budgeting and travel planning.

Objectives of the Central Sales Tax Act

You may conduct trading from your state to another state in India, then the Central Sales Tax Board allows you to levy, collect, and distribute taxes obtained for the sale of goods.

The Board of Central Sales Tax is the only competent authority to settle interstate trade disputes.

Sales Tax Calculator Formula

A sales tax calculator helps you quickly find the total cost of an item, including tax. It’s especially useful for shoppers, businesses, and online sellers. The basic formula used in a sales tax calculator is:

Sales Tax = (Original Price × Sales Tax Rate) / 100

Total Price = Original Price + Sales Tax

For example, if an item costs ₹1,000 and the tax rate is 10%, the sales tax would be ₹100. So, the total price becomes ₹1,100. This simple formula saves time and avoids manual calculation errors. It’s also helpful for budgeting and comparing product prices across regions with different tax rates.

Many online calculators let you enter the price and tax rate to get instant results. Using a sales tax calculator makes shopping smarter and billing easier, especially for businesses that need accurate pricing and invoices.

Central Sales Tax (CST):

Central Sales Tax (CST) Transaction Forms distributed to the dealers (sellers) will have to keep up certain guidelines and declarations in prescribed forms.

Sellers will be allowed to have access to several types of CST forms that are meant to fulfill specific purposes.

These forms are Form C, Form D, Form E1, Form E2, Form F, Form H, & Form I.

Form C acknowledges the goods bought by the dealer from the seller at a concessional rate.

Form D is provided by the government department to the dealer on purchasing the goods

Form E1 contains the information of the inter-state movement of goods and it is issued by the dealer.

Form E2 contains the information of the goods on crossing from one state to another and is issued by the seller.

Form F contains information on goods for sending it to a different state.

Form H contains the relevant information on the purchase of goods and the exporter issues it.

Form I is applicable in Special Economic Zones and the dealer issues it.

Applications of Sales Tax Calculator

A Sales Tax Calculator is a practical tool widely used by both consumers and businesses to determine the exact amount of tax applied to a purchase.

Its main application is in retail, where customers can quickly calculate the total cost of an item, including the applicable sales tax, based on their state or regional tax rate.

For businesses, this calculator is essential for accurate pricing, invoicing, and financial planning. It helps ensure compliance with tax regulations by applying the correct tax rates to goods or services.

Online stores also integrate sales tax calculators to provide transparent checkout experiences for their customers.

Accountants and finance professionals use it to verify tax amounts and generate accurate reports.

Whether shopping, managing a business, or preparing taxes, a sales tax calculator simplifies calculations, saves time, and minimizes errors—making it an indispensable tool for everyday and professional use.

Planning other aspects of life? Use our handy Age Calculator to find out your exact age in years, months, and days.

Advantages of Sales Tax Calculator

A Sales Tax Calculator offers several key advantages for businesses and consumers alike. One of the primary benefits is accuracy; it ensures the correct tax amount is applied to each transaction, reducing the risk of errors.

This is especially crucial for businesses operating across different regions with varying tax rates.

Another advantage is time efficiency. By automatically calculating sales tax, businesses can save valuable time that would otherwise be spent manually determining rates. This also speeds up the checkout process, improving customer experience.

For businesses, a Sales Tax Calculator helps in compliance with local tax laws, avoiding penalties and audits. It also provides clarity on pricing, which enhances transparency and customer trust.

In summary, the Sales Tax Calculator streamlines tax calculations, ensuring accuracy, saving time, and helping businesses stay compliant with tax regulations, all while improving customer satisfaction.

FAQ on Sales Tax

Q1. What is Sales Tax in India?

Ans: Sales tax is a tax levied by the government on the sale of goods and services. Traditionally there was a state-level tax before introducing GST. However, with the introduction of the Goods and Services Tax (GST) in 2017, the concept of traditional sales tax has been replaced.

Q2. What is the Goods and Services Tax (GST)?

Ans: GST is a comprehensive, multi-stage, destination-based tax that is levied on every value addition. GST replaced many indirect taxes previously levied by the central and state governments, including sales tax. It is designed to create a single, unified market, making India a common market with uniform tax rates and procedures.

Q3. How is GST different from Sales Tax?

Ans: GST incuded various indirect taxes, including sales tax, service tax, excise duty, and more. Unlike sales tax, which was levied only on the sale of goods, GST is levied on both goods and services. GST aims to eliminate the cascading effect of taxes (tax on tax) seen under the previous system.

Q4. What are the different types of GST?

Ans: GST in India is divided into three categories:

-

Central GST (CGST): Collected by the central government on intra-state sales.

-

State GST (SGST): Collected by the state government on intra-state sales.

-

Integrated GST (IGST): Collected by the central government on inter-state sales and imports.

Q5. What is the GST rate in India?

Ans: GST rates in India depends on the type of goods or services. The available GST slabs are:

-

0% (Exempted Goods): Essential items like fresh produce.

-

5%: Items of mass consumption.

-

12%: Standard goods and services.

-

18%: Standard goods and services, including most services.

-

28%: Luxury items and sin goods.

Q6. Can I calculate reverse sales tax using a Sales Tax Calculator?

Ans: Yes, many Sales Tax Calculators have a reverse tax feature. This helps you find out the original price before tax if you only know the total price and the tax rate.

Q7. How often should I use a Sales Tax Calculator?

Ans: You can use it whenever you're planning a purchase, especially for large expenses or when shopping in regions with different tax rates. It's also handy for budgeting and financial planning.

Q8. Can a Sales Tax Calculator handle different tax rates?

Ans: Yes, most Sales Tax Calculators allow you to enter different tax rates, which is useful in regions with varying sales taxes. Some calculators also include options for additional state and local taxes.

Q9. Can the calculator show price before tax too?

Ans: Yes, some calculators can work both ways. You can enter the total price including tax, and it will help you find out the original price before tax was added.

Q10.Can I use a sales tax calculator for any state or country?

Ans: Yes, most sales tax calculators let you enter any tax rate. This makes it useful for different states, cities, or even countries with their own tax rules.

Q11.How can I find the sales tax rate for my area?

Ans: You can find the sales tax rate for your area by checking with your local government’s website or using a Sales Tax Calculator that automatically adjusts the rate based on your location. Many online tools also offer a lookup feature to find the applicable sales tax rate by entering your address or zip code.

Q13. Why should I use a Sales Tax Calculator?

Ans: Using a Sales Tax Calculator helps you easily figure out the total cost of an item, including tax, without doing manual calculations. It saves time and ensures accuracy, especially when purchasing multiple items or in areas with varying tax rates.

Q14. Is the Sales Tax Calculator free to use?

Ans: Yes, most sales tax calculators are completely free to use. You don’t need to download anything or sign up.