ZERODHA BROKERAGE CALCULATOR

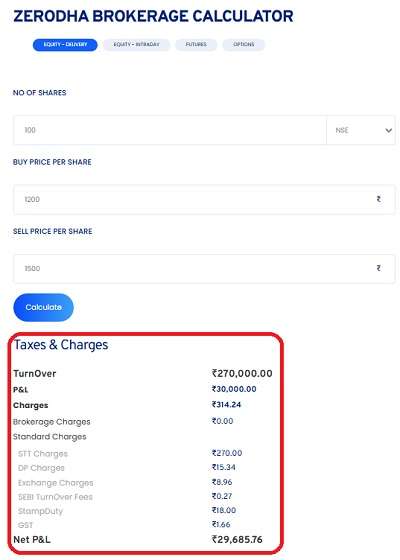

Taxes & Charges

TurnOver

P&L

Charges

Brokerage Charges

STT Charges

DP Charges

Exchange Charges

SEBI TurnOver Fees

StampDuty

GST

Net P&L

What is Zerodha Brokerage Calculator?

Toolerz Zerodha Brokerage Calculator is an online tool designed to help traders and investors calculate the brokerage fees and other charges associated with their trades on Zerodha Kite.

Understanding brokerage charges is crucial for any trader/ investor. We, toolerz offering a free brokerage calculator to estimate the charges before you invest/ trade in the live market.

It provides a clear and detailed breakdown of the costs involved, helping users to estimate their net profit or loss for each trade.

Note: The brokerage chharges shown in this calculator (Zerodha Brokerage Calculator) is specifically applicable for the users of Zerodha website only.

If you are unaware of using this tool you can follow the below simple steps.

How to Use our Zerodha Brokerage Calculator

Using our Zerodha Brokerage Calculator is very simple and can be easily understandable.

Here is a step-by-step guide to use our tool:

Step 1: Access the Calculator

Visit the Toolerz website (www.toolerz.com).

Search for ‘Zerodha Brokerage Calculator’ in the searcch bar & click on the dropdown.

Step 2: Select the Type of Trade

After entering the tool's page, choose the type of trade you want to calculate:

For Example: Equity, Futures, Options, Currency, or Commodity.

Step 3: Enter Trade Details

Enter the trade details like

Buy Price: Enter the price at which you plan to buy the security.

Sell Price: Enter the price at which you plan to sell the security.

Quantity: Enter the number of shares, lots, or contracts.

Select the Exchange: Slect the exchange NSE/ BSE.

Step 4: Calculate

Click on the ‘Calculate’ button to get the brokerage charges.

The calculator will compute the charges & displays a detailed breakdown of the charges, including brokerage, STT (Securities Transaction Tax), transaction charges, GST, SEBI charges, and stamp duty.

It will also show the net profit or loss after accounting for all charges.

Key Features of Zerodha Brokerage Calculator

The Zerodha Brokerage Calculator is a powerful and user-friendly tool designed to help traders and investors quickly estimate their trading costs.

One of its key features is real-time calculation, allowing users to see accurate charges for equity, F&O, commodities, and currency trades.

It provides a clear breakdown of all fees, including brokerage, exchange charges, GST, SEBI charges, and stamp duty. This helps users understand their total cost per trade and the breakeven point for profits.

The calculator is accessible online and mobile-friendly, making it convenient for on-the-go calculations. It also supports both intraday and delivery trades, offering flexibility to different trading styles.

With a simple interface and fast results, the Zerodha Brokerage Calculator is an essential tool for making informed trading decisions and managing costs effectively.

Zerodha Kite Brokerage Charges

Zerodha is known for its low brokerage charges, which is one of the reasons it has become so popular among traders and investors in India.

Here is a detailed look at the brokerage charges for different types of trades on Zerodha Kite.

- Equity Delivery: For equity delivery trades, Zerodha does not charge any brokerage. This means you can buy and hold shares without worrying about brokerage fees.

- Equity Intraday: For intraday trades in the equity segment, Zerodha charges a flat fee of ₹20 or 0.03% of the trade value, whichever is lower.

- Equity Futures: The brokerage for trading in equity futures is also a flat fee of ₹20 or 0.03% of the trade value, whichever is lower.

- Equity Options: For equity options, Zerodha charges a flat fee of ₹20 per executed order.

- Currency Futures and Options: The brokerage for currency futures and options is a flat fee of ₹20 or 0.03% of the trade value, whichever is lower.

For those looking to maximize their savings, explore our FD Calculator to estimate your fixed deposit returns effortlessly. Use our simple and easy-to-use tools to make informed decisions and stay ahead in your financial journey.

Brokerage Charges for Intraday Trading

Intraday trading involves buying and selling shares within the same trading day.

Here is a breakdown of the brokerage charges for intraday trading on Zerodha:

- Brokerage: ₹20 or 0.03% of the trade value, whichever is lower.

- STT (Securities Transaction Tax): 0.025% on the sell side.

- Transaction Charges: NSE: 0.00345%, BSE: 0.003%.

- GST: 18% on brokerage and transaction charges.

- SEBI Charges: ₹10 per crore.

- Stamp Duty: As per the state of residence.

Looking for financial planning tools? Try our FD Calculator to calculate fixed deposit returns and make smarter investment decisions.

What advantages does a Zerodha brokerage calculator offer?

A Zerodha Brokerage Calculator is a handy tool that helps traders calculate the exact cost of their trades before placing them. It breaks down all charges like brokerage fees, GST, exchange fees, SEBI charges, and stamp duty. This gives you a clear picture of your net profit or loss after all deductions.

One of the main advantages of using Zerodha’s calculator is transparency. You don’t have to guess or be surprised by hidden charges. It works for different segments like equity delivery, intraday, F&O, currency, and stock

Another key benefit is easy comparison. You can compare charges across different trades and plan smarter strategies. It saves time and helps you stay in control of your trading costs.

Overall, the Zerodha Brokerage Calculator is perfect for both beginners and experienced traders who want accurate cost estimates and better decision-making in the stock market..

Benefits of Zerodha Brokerage Calculator

The Zerodha Brokerage Calculator is a valuable tool for traders and investors who want to estimate the exact charges applied on each trade. One of its key benefits is transparency—it breaks down all costs including brokerage, taxes, SEBI charges, and transaction fees.

This helps users clearly understand their total expenses before placing a trade. The calculator supports multiple segments like equity, F&O, commodities, and currency, making it suitable for all types of traders.

It also helps in comparing potential profits or losses after accounting for charges, which is essential for better financial planning.

Easy to use and available online, the Zerodha Brokerage Calculator saves time, reduces guesswork, and helps traders make smarter, cost-effective decisions.

Whether you're a beginner or an experienced trader, this tool is a must-have to stay informed and confident in your trading journey.

Is Zerodha Brokerage Fee High?

Zerodha is known for offering one of the most competitive brokerage structures in India. Compared to traditional stockbrokers, Zerodhas fees are considered low and transparent. For equity delivery trades, Zerodha charges zero brokerage, which is a big plus for long-term investors.

For intraday and FO (Futures and Options) trades, the brokerage is capped at ₹20 per executed order or 0.03%, whichever is lower.

This flat-fee model makes Zerodha an affordable choice, especially for high-volume traders. There are no hidden charges, and all fees are clearly mentioned upfront. While some investors may find full-service brokers offering personalized advice worth the extra cost, for self-directed traders, Zerodha provides great value.

In conclusion, Zerodha's brokerage fees are not high. In fact, they are among the lowest in the industry, making it a preferred platform for cost-conscious and tech-savvy investors in India.

Brokerage Charges for Options Buying and Selling

Here is the detailed breakdown of brokerage charges of buying and selling shares in Zerodha Kite.

Equity Options

- Brokerage: ₹20 per executed order.

- STT: 0.05% on the sell side (premium).

- Transaction Charges: NSE: 0.053%.

- GST: 18% on brokerage and transaction charges.

- SEBI Charges: ₹10 per crore.

- Stamp Duty: As per the state of residence.

Currency Options

- Brokerage: ₹20 or 0.03% of the trade value, whichever is lower.

- STT: None.

- Transaction Charges: NSE: 0.0011%.

- GST: 18% on brokerage and transaction charges.

- SEBI Charges: ₹10 per crore.

- Stamp Duty: As per the state of residence.

Commodity Options

- Brokerage: ₹20 or 0.03% of the trade value, whichever is lower.

- STT: 0.05% on the sell side.

- Transaction Charges: MCX: 0.0026%.

- GST: 18% on brokerage and transaction charges.

- SEBI Charges: ₹10 per crore.

- Stamp Duty: As per the state of residence.

For those planning long-term investments, you can also check out our SIP Calculator to plan your mutual fund investments smartly.

Applications of Zerodha Brokerage Calculator

The Zerodha Brokerage Calculator is a practical tool that helps traders and investors make smart financial decisions. One of its main applications is calculating the total cost of a trade before placing an order.

This includes brokerage, taxes, and other regulatory charges. It helps users understand the exact profit or loss they can expect from a trade.

The calculator is also useful for comparing costs between intraday and delivery trades, helping traders choose the most cost-effective option.

For active traders, it assists in setting realistic profit targets by showing the breakeven point. Additionally, beginners can use it to learn how different charges impact their returns.

Whether you're trading in equity, F&O, commodities, or currency, the Zerodha Brokerage Calculator provides clear and instant insights, making it easier to plan trades and manage costs efficiently.

Frequently Asked Questions

Q1. What is the Toolerz Zerodha Brokerage Calculator?

Ans: The Toolerz Zerodha Brokerage Calculator is a free online tool that helps traders calculate the brokerage fees and other charges associated with their trades on Zerodha. The calculations performed in this tool are 100% accurate to the original tool.

Q2. How do I access the Zerodha Brokerage Calculator?

Ans: You can access the Zerodha Brokerage Calculator here.

Q3. Is the Toolerz Zerodha Brokerage Calculator free to use?

Ans: Yes, our Zerodha Brokerage Calculator is free to use for all traders and investors.

Q4. What types of trades can I calculate using this tool?

Ans: You can calculate brokerage charges for equity, futures, options, currency, and commodity trades.

Q5. Does the calculator include all types of charges?

Ans: Yes, the calculator provides all types of charges such as brokerage, STT, transaction charges, GST, SEBI charges, and stamp duty.

Q6. How accurate is the Toolerz Zerodha Brokerage Calculator?

Ans: The Toolerz calculator is 100% accurate as it uses the latest charges and rates provided by Zerodha.

Q7. How to Login to my Zerodha Account Online?

Ans: Visit www.kite.zerodha.com website enter your login credentials like Kite ID & Password to enter your dashboard.

Q8. Does this tool calculates stamp duty?

Ans: Yes, the calculator accounts for stamp duty based on the state of residence.

Q9. What is the brokerage charge for equity delivery trades?

Ans: Zerodha does not charge any brokerage for equity delivery trades.

Q10. How is the brokerage for options trading calculated?

Ans: The brokerage for options trading is a flat fee of ₹20 per executed order.

Q11. What are the transaction charges for intraday trading?

Ans: The transaction charges for intraday trading are NSE: 0.00345% and BSE: 0.003%.

Q12. How do I know if the calculated charges are correct?

Ans: Our Zerodha Brokerage Calculator provides a detailed breakdown of all charges, ensuring transparency and accuracy.

Q13. Can I use the calculator for planning my trades?

Ans: Yes, the calculator is a must use tool for planning trades by providing a clear picture of the costs involved.

Q14. Are there any hidden charges not shown in the calculator?

Ans: No, the Zerodha Brokerage Calculator includes all possible charges, ensuring there are no hidden costs.

Q15. How often is the calculator updated?

Ans: The calculator is updated regularly to reflect the latest charges and rates provided by Zerodha. We usually update the tool everytime the price changes in SEBI & ZERODHA.

Q16. Can I use the Zerodha Brokerage Calculator for all segments?

Ans: Yes, the Zerodha Brokerage Calculator works for all trading segments, including:

- Equity (Delivery & Intraday)

- Futures & Options (F&O)

- Commodity Trading

- Currency Trading

Each segment has different charges, but the calculator gives a breakdown for all.

Q17. Can I use the calculator for intraday trading?

Ans: Yes, you can use the calculator to get the brokerage and other charges for intraday trading.

Q18. Is the Zerodha Brokerage Calculator suitable for beginners?

Ans: Absolutely! It’s very simple to use and doesn’t require any special knowledge. If you're new to trading, it helps you understand how much money goes into each trade.

Q19. Why should I use a brokerage calculator before trading?

Ans:Using a brokerage calculator helps you plan your trades better. It shows you how much you need to gain to make a profit after all charges are deducted.

Q20. Can beginners use the Zerodha Brokerage Calculator easily?

Ans:Absolutely! The tool is designed for all users, including beginners. Just enter a few trade details, and the calculator will do the rest..

Q21. Can I use the calculator on mobile?

Ans:Yes, the Zerodha Brokerage Calculator works well on mobile phones too. You can use it through your phone’s browser and get results instantly, just like on a computer.

Q22. Can I use the Zerodha Brokerage Calculator for intraday and delivery trades?

Ans:Yes, the calculator works for both intraday and delivery trades. Just select the correct segment and input your trade details. It will calculate the charges based on Zerodha's pricing structure.