ANGEL ONE BROKERAGE CALCULATOR

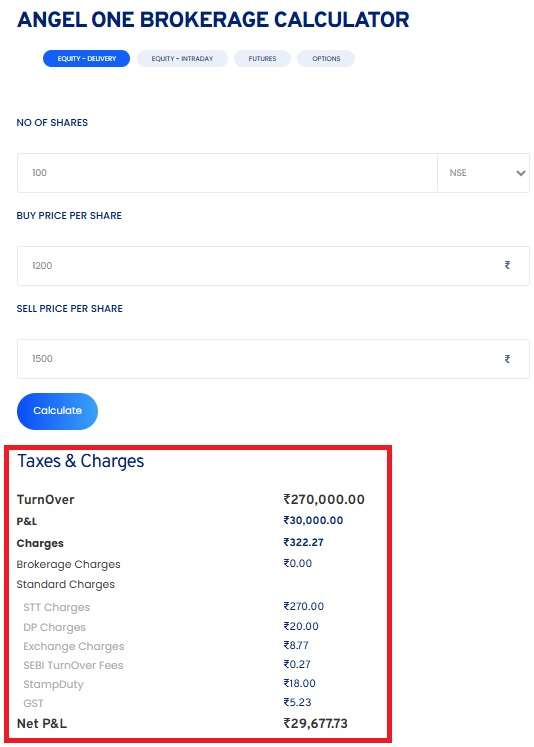

Taxes & Charges

TurnOver

P&L

Charges

Brokerage Charges

STT Charges

DP Charges

Exchange Charges

SEBI TurnOver Fees

StampDuty

GST

Net P&L

What is Angel One Brokerage Calculator?

The Angel One website has its own brokerage calculator, we have designed a similar calculator that gives the same result as the Angel One Brokerage Calculator.

Toolerz Aongle One Brokerage Calculator is a free online tool that helps traders calculate brokerage fees and other taxes/ charges for trades executed on the Angel One platform.

Those who wish to know the costs associated with the trades they execute in this particular platform can utilize this tool.

The below lines show how to use this tool to calculate the charges.

How to Use the Calculator

Using our Angel One Brokerage Calculator is very simple. Here is the step-by-step guide that assist you in calculating the brokerage fee.

Step 1: Go to the Calculator's Page

Visit our website (www.toolerz.com) and search for the term "Angel One Brokerage Calculator".

Click on the dropdown and enter the calculator page.

Step 2: Select the Segment

On top of the calculator, there is a list of trading segments, click on the segment that you wish to calculate the brokerage fee.

Here is the list of segments

- Equity Delivery

- Equity Intraday

- Futures

- Options

Step 3: Enter Trade Details

Enter the necessary trade details, such as:

- Buy Price

- Sell Price

- Quantity

Step 4: Calculate

Click on the "Calculate" button. The calculator will process the information and display the brokerage fee along with other charges like transaction charges, GST, SEBI charges, and stamp duty.

Step 5: Review Results

The results will show a detailed breakdown of the costs involved, helping you understand the total expenditure for the trade.

Review the charges and plan your trading accordingly.

Happy Trading!

Benefits of our Calculator

1. 100% Accuracy

Our Angel One Brokerage Calculator provides 100% accurate calculations, ensuring traders have a clear understanding of their costs. The formula that we use for each segment is as same as the official website.

2. User-Friendly Interface

Our user-friendly interface and easy-to-use options make it easy for both novice and experienced traders to use the calculator effectively.

3. Time-Saving

By calculating the brokerage charges before executing the actual trade saves valuable time and helps you understand the market.

4. Multiple Trading Segments

Our calculator covers a wide range of trading segments like equity, delivery, options, futures, and commodities.

5. Free Tool

Whether you use it one time or 1000 times, our tool is absolutely free to use for both personal and business purposes.

Angel One Brokerage Charges

Angel One is known for its competitive brokerage charges across various trading segments. The following is the list of charges according to the trading segment.

Equity Delivery: 0.25% of the transaction value

Equity Intraday: 0.03% of the transaction value

Equity Futures: ₹20 per executed order

Equity Options: ₹20 per executed order

Currency Futures: ₹20 per executed order

Currency Options: ₹20 per executed order

Commodity Trading: ₹20 per executed order

Conclusion of Angel One Brokerage Calculator

The Angel One Brokerage Calculator is an essential tool for traders and investors looking to assess their trading costs effectively.

It provides a clear and accurate breakdown of brokerage fees, taxes, and other charges associated with different types of trades, such as equity, futures, options, and commodities.

By offering precise cost calculations, the tool helps users make well-informed investment decisions and optimize their trading strategies. It also enables traders to compare costs across various asset classes, ensuring transparency and better financial planning.

Overall, the Angel One Brokerage Calculator empowers investors to minimize trading expenses and maximize potential returns, making it a valuable resource for both novice and experienced traders.

Why Angel One is Called a Discount Broker?

After the launch of Zerodha, many brokers have turned to discount brokers. Angel One is also added to the discount brokerage list due to its significantly lower brokerage charges.

Here are a few key reasons:

Low-Cost Structure

Angel One charges a flat fee of ₹20 per executed order across various segments, making it affordable for traders with different investment capacities.

No Hidden Charges

Angle One maintains transparency in its brokerage charges.

From Angel Broking to Angel One

Angel Broking has rebranded itself as Angel One to reflect its evolution into a comprehensive financial services provider.

This rebranding shows its commitment to leveraging technology and innovation to provide a wide range of financial services beyond traditional broking.

Looking for more brokerage calculators? Try our Upstox Brokerage Calculator to compare costs and maximize your trading profits.

Best Discount Brokers in India

Zerodha

Zerodha is the largest discount broker in India, known for its low-cost structure and robust trading platform.

Try Zerodha Brokerage Calculator

Angel One

Angel One combines low brokerage charges with a comprehensive suite of financial services, making it a top choice for traders and investors.

Upstox

Upstox offers competitive brokerage rates and a user-friendly trading platform, making it a popular choice among traders.

Try Upstox Brokerage Calculator

How to Calculate DP Charges in Angel One?

DP (Depository Participant) charges in Angel One are fees charged when you sell shares from your Demat account.

These are not brokerage charges but are levied by the depository (like CDSL) through the broker. As of now,Angel One charges ₹20 + GST per scrip per day when you sell delivery-based shares.

To calculate DP charges, simply note how many different stocks (scrips) you are selling on a particular day. If you sell two different stocks on the same day, the DP charge will be ₹20 + GST for each, totaling ₹40 + GST.

It's important to remember that these charges are applied only on the sell side and not on intraday or F&O trades. Always check your contract note or Angel One’s official website for the latest DP charge updates.

Understanding these charges helps you better manage trading costs and plan your investments smartly.

Angel One Unlimited Brokerage Charges

As of now, Angel One does not offer an unlimited brokerage plan. It focuses on providing low-cost trading services with a flat fee structure to keep trading affordable for its users.

Check the free structure in the above lines.

Other Charges on Trading

When you trade in the stock market, there are additional costs beyond just buying or selling shares. These are known as "other charges on trading" and can impact your overall profit. Common charges include brokerage fees, which are paid to your trading platform for executing your trades.

You’ll also find charges like Securities Transaction Tax (STT), GST (Goods and Services Tax), stamp duty, SEBI turnover fees, and transaction charges from the stock exchange. These fees vary based on the type and volume of your trade.

It’s important to be aware of these costs so you can plan your trades wisely. Even small charges can add up over time and affect your returns. Always check the fee structure of your broker before trading. Understanding all trading charges helps you make smarter, more informed investment decisions.

Want to compare brokerage across platforms? Try our 5paisa Brokerage Calculator for quick insights.

Factors Influencing Brokerage Charges

Brokerage charges are the fees traders pay to brokers for buying or selling stocks and other securities. These charges can vary based on several key factors. One major factor is the type of broker—full-service brokers usually charge more than discount brokers, as they offer additional services like research and advisory.

The type of trade also matters. Intraday trading often has lower charges compared to delivery trades. Trade volume and value can influence costs too; higher trade amounts might lead to higher total charges, though some brokers offer lower rates for high-volume traders.

Other factors include the market segment (equity, F&O, currency, or commodities), brokerage plans, and any special offers or discounts. Additionally, regulatory and statutory charges like GST, SEBI fees, and transaction charges are added separately.

Examples of Brokerage Calculation

Example 1: Equity Delivery

Let us assume,

Buy Price: ₹100, Sell Price: ₹120, Quantity: 100

Transaction Value: 100 x 100 = 10,000

Brokerage = 10,000 x 0.25% = Rs. 25

Key Features of Angel One Brokerage Calculator

The Angel One Brokerage Calculator is a comprehensive tool designed to help traders and investors accurately calculate the brokerage charges for various trading segments such as equity, commodities, currencies, and derivatives.

One of its key features is the ability to provide a detailed cost breakdown, including brokerage fees, transaction charges, GST, and stamp duty. It also enables users to compare costs across different asset classes, making it easier to evaluate potential returns.

The calculator is user-friendly, allowing quick input of trade details to generate instant results. Additionally, it helps in determining the breakeven point by showing the minimum price movement required to cover costs.

This transparency empowers traders to make well-informed decisions, optimize trading strategies, and manage expenses effectively.

Frequently Asked Questions

Q1. What is the Toolerz Angel One Brokerage Calculator?

Ans: It is an online tool that calculates the brokerage and other charges for trades executed on the Angel One platform.

Q2. Is the Angel One Brokerage Calculator free to use?

Ans: Yes, our brokerage calculator is free to all users www.toolerz.com .

Q3. Does it cover all trading segments?

Ans: Yes, it covers equity delivery, equity intraday, futures, options, and currency trading.

Q4. How often is the calculator updated?

Ans: The calculator is updated regularly to reflect any changes in brokerage charges or regulatory fees. We take inputs from the official website and reflect the same here.

Q5. Can it be used for back-testing trades?

Ans: Yes, traders can use historical data to back-test their trades and understand past charges.

Q6. Is there a mobile app for the Toolerz Angel One Brokerage Calculator?

Ans: No, we don't have any mobile app but our website is compatible with mobile devices also.

Q7. Does this calculator include all charges?

Ans: Yes, it includes brokerage, transaction charges, GST, SEBI charges, and stamp duty.

Q8. Can I save my calculations?

Ans: No, there is no option to save the calculations, instead you can take a screenshot for your reference.

Q9. Does it support multiple trades at once?

Ans: No, Users have to choose one segment at a time.

Q10. How accurate is this calculator?

Ans: Our tool is 100% accurate. The calculations of all segments are as same as the Angel One official calculator.

Q11. Can it be used by non-Angel One customers?

Ans: These charges are applicable for Angel One users only, other users can try that particular broker's calculator.

Q12. Does this tool work offline?

Ans: No, it requires an internet connection to function.

Q13. Are there any hidden charges not shown by the calculator?

Ans: The calculator is designed to include all charges to ensure transparency.

Q14. Can I use the calculator for different trading segments?

Ans: Yes! The Angel One Brokerage Calculator works for:

Q15. Where can I find the Angel One Brokerage Calculator?

Ans: You can find the Angel One Brokerage Calculator on the official(www.toolerz.com) website under the "Brokerage Calculator" section.

Q16. Does the calculator work on mobile devices?

Ans: Yes, the Angel One Brokerage Calculator is mobile-friendly. You can use it on your phone or tablet, just like on a desktop. It’s quick, responsive, and easy to use on any device.

Q17. Is Angel One’s brokerage same for all trades?

Ans: No, it depends on the trade type. Angel One often charges zero brokerage for equity delivery and a flat fee for intraday and F&O trades. The calculator adjusts this automatically.

Q18. Does it help in profit planning?

Ans: Yes, by showing you all the costs and final profit or loss, the calculator helps you plan trades better and avoid surprises in your trading account.

Q19.Does the calculator include all charges?

Ans: Yes, it includes:

Brokerage fees

SEBI charges

Exchange transaction charges

GST

Stamp duty

So, you get a full view of all costs involved.